Term Life Insurance Quotes

Why should you buy a 20 year term life insurance policy? Even though life insurance can be complicated and confusing, most consumers know a little about term life insurance. Generally, U.S. consumers understand that term life insurance is much cheaper than other kinds of insurance like whole life or universal life insurance.

Even though term life insurance is considered temporary, it is so affordable that most Americans will choose it first because it’s so affordable that you can purchase a lot of coverage at very reasonable rates. Term insurance can also be used for many purposes, even if you need coverage for a lifetime (more about that later).

- Replace the income stream that was provided by the primary breadwinner in the household.

- Provide replacement funds for purposes that are considered short-term, like mortgage protection or funding for college.

- Business use for funding a Buy/Sell agreement or insuring a key person in the company.

What most consumers do not know about term life insurance, however, is that most policies come with a “conversion privilege” that enables a policyholder to change their policy from temporary to permanent.

The conversion privilege enables a policyholder with a less expensive 20 year term life insurance policy to convert it before the end of the term to a permanent policy like whole life or universal life. We call it a privilege because when the insured decides to convert all or some of the coverage to permanent life insurance, they do not have to prove they are healthy (proof of insurability).

If your need for a huge amount of life insurance is 20 years or less, why would you purchase a 30-year policy, which costs significantly more than a 20-year policy?

Here’s an Argument for Buying 20 Year Term Life Insurance

John is married and has two children in middle school. During the early years of John’s marriage, he and his spouse racked up significant debt due to buying a new home with a 15-year mortgage, having several credit cards, owning 2 vehicles, and taking out a personal loan to buy the family a fishing boat.

John has group term insurance through his employer, but the face amount is only twice his annual salary, and John understands that if he leaves his employer, his insurance will not leave with him. John’s best friend is an insurance agent and has asked John to let him do a “needs analysis,” so John will know if he has enough coverage.

Here is John’s life insurance Needs Analysis for His Family:

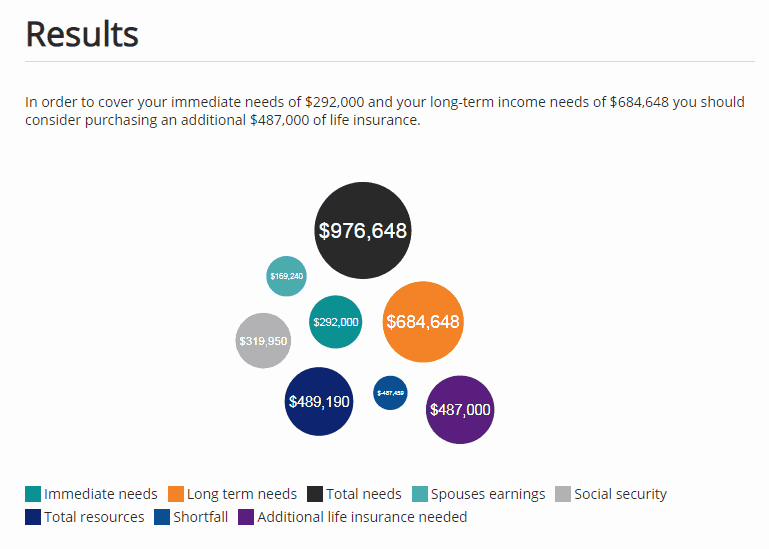

John’s insurance needs a total of $976,648 when we consider the following:

- Immediate needs

- Long term needs

- His spouse’s earnings

- His spouse’s social security benefits

- Total current resources

For the purpose of this example, we can round John’s insurance needs up to $1,000,000

How Much Will John’s Insurance Cost?

Term Life insurance rates are based on four primary things: the age of the applicant, the health of the applicant, the face amount (death benefit) of the policy, and the term of the policy. In John’s case, we are going to compare the rates for a 20 year term life insurance policy with a 30-year term life insurance policy. We will also assume that John’s is a healthy non-smoker:

| Coverage Term | Monthly Cost | Total Term Costs |

| 30-Year Term | $85.50 | $30,780.00 |

| 20-Year Term | $50.06 | $12,014.40 |

| Savings with 20-Year Term | $35.44 per month | $18,765.60 Total |

Please note that from these actual quotes, John would save $35.44 per month or $18,765 over the term of the 20-year policy versus the 30-year policy

Shouldn’t I buy the Longest Term Possible?

This is certainly what most insurance agents will recommend since they are paid on a percentage of the life insurance premium, but practically speaking, in John’s case, the 20-year term policy makes better sense economically. Here’s why

- John and his wife have a 20-year mortgage

- John’s children will likely be in college in less than 20 years

- John will likely have paid down his debt substantially in 20 years

So then, based on these statements, John’s insurance need is for a 20-year, 1-million dollar policy.

What Happens When My 20-Year Policy Expires?

For policyholders who purchase a 20-year term life insurance policy, they do have choices when the policy is about to expire:

The insurer will likely offer a renewal, but the rates will be based on your attained age (age at renewal), and the policy will have a term of only one year.

A policyholder who purchased a 20-year term life insurance policy that contains the conversion privilege can elect to convert their term coverage to permanent coverage before the expiration date. This means instead of renewing the term coverage for one year and then paying higher rates each year you renew it, you can elect a permanent policy like whole life or universal life and not have to worry about medical underwriting. Yes, your policy will cost more because of your attained age and the type of policy you select, but you do not have to keep the same face amount. For example, in John’s case, he would have paid off his mortgage, and the kids would have gone to college; and therefore, he would not have as much life insurance at the time of his conversion.

You can do nothing (not recommended).

What else should I know about 20-year Term Life Insurance?

Most insurance companies offer several insurance riders (optional coverage) that can be added to the term policy, which can broaden the coverage and offer some living benefits. For example, if your policy doesn’t have the Accelerated Death Benefit added automatically, you can typically choose to add the rider to your policy at no additional charge.

Other riders that can be advantageous are the Waiver of Premium rider, the Return of Premium rider, the Children’s Term rider, and the Accidental Death Benefit rider.

In Conclusion

If you are in your 20s or early 30s and cannot afford to cover your insurance needs with permanent insurance, consider a very affordable 20-year term life insurance policy that has a conversion privilege and then convert it down the road when you are earning more money and probably need less life insurance.

Speak with a Professional

For more information about 20-Year Term Life Insurance and to get a free and confidential quote, call the insurance professionals at LifeInsure.com at (866) 868-0099 during normal business hours or contact us through our website.

Term Life Life Insurance Quotes

Last Updated on August 17, 2024 by Richard Reich