Term Life Insurance Quotes

When you purchase a life insurance policy, you are essentially providing your surviving loved ones with a financial safety net that will help them move on without your income stream.

Life insurance policies will typically fall into three basic types of coverage: term insurance (temporary), whole life (permanent) and universal life (can be temporary or permanent).

But, you also have the ability to build a life insurance plan which is commonly known as life insurance insurance laddering so that your coverage and premiums will change as your lifetime insurance needs change..

Easy Article Navigation

What is an Insurance Ladder?

Just like a traditional ladder has rungs, a life insurance ladder has rungs of different types of life insurance that enable you to reach a financial goal at a more affordable cost. In other words, you purchase multiple types of life insurance products that will allow your investments to mature at different rates.

Take CDs for example, you can ladder your CDs so that they mature at different times. Instead of buying one CD for $5,000, you can invest that money in a series of CDs that will mature at different times like one year, three years, and five years. You then have the option of reinvesting that money into another series of CDs or into one five-year CD.

How does a Life Insurance Ladder Work?

A life insurance ladder is simply a strategy for buying the coverage you need at the most affordable rate and only keeping that coverage for a necessary period of time. For example, if you want to make certain your 15-year mortgage is paid off if you die, why would you spend the extra money to purchase that coverage for 30 years?

It sounds complicated but it really isn’t. In fact, many insurance professionals recommend the life insurance ladder for applicants who cannot pay the premium for their entire life insurance needs and want to save money over the life of their policies.

It’s a common understanding that the head of household will experience a drop in how much life he or she needs over time and a common problem is that he or she may not have the resources to purchase their entire face amount needs early in life, even though this is when the rates are the lowest.

A Simple Financial Case Study

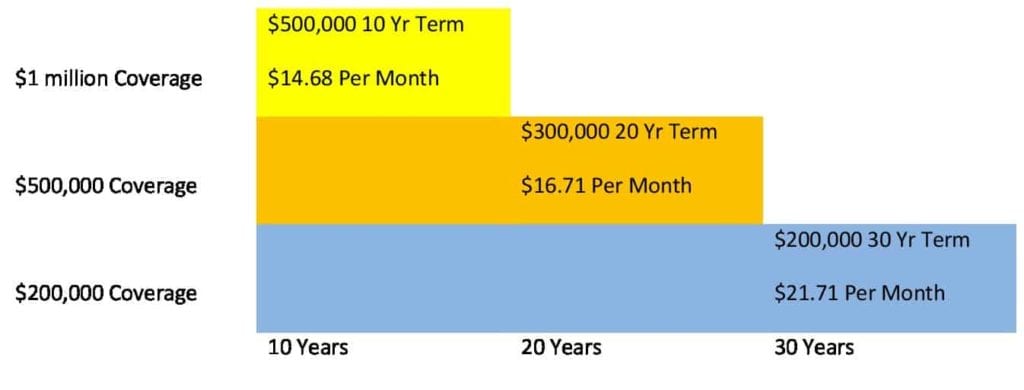

Let’s say John and his insurance agent have determined that based on his life insurance needs analysis he needs $1 million in coverage now, but he and his agent expect those needs to diminish as time goes by because debts will have been reduced and the mortgage will be paid down substantially thereby reducing his family’s financial needs. Here is how John can implement a ladder strategy to save substantial money:

$1,000,000 Life Insurance

Ladder Strategy versus Single Policy

Total Lifetime Cost of the Ladder Strategy: $13,587.60

Total Lifetime Cost of Single Policy: $25,120.80

Total Lifetime Premium Savings: $11,533.20

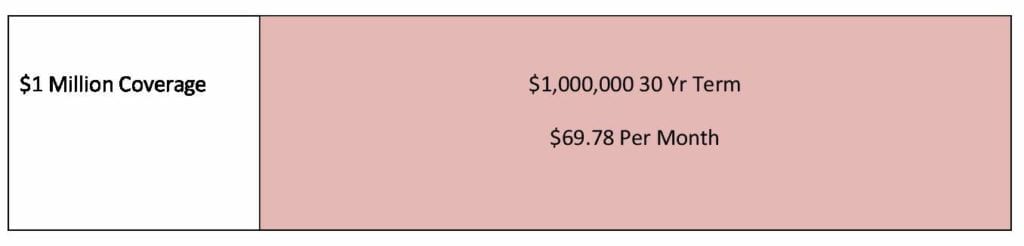

So then, let’s drill down to what’s going on here. First, we’ll consider a single life insurance policy for $1 million in coverage. John is a 36-year old non-smoker and in good health with average financial needs. His 30-year term policy without all the bells and whistles would cost him $69.78 per month, which translates into $25,120.80 for the life of the policy.

But according to John, he does not need the $1 million in life insurance coverage over the entire 30 year period because he knows when his debts will be reduced and when his mortgage will be paid off and he doesn’t have any debt from student loans. So rather than buying a single policy, it makes better financial sense to ladder life insurance coverage so that the face amount of his total coverage is reduced during key periods in his life which, in his case, can be accomplished by laddering three policies with different face amounts and for different terms that will cover his spouse’s financial needs.

John and his agent decide on the following strategy:

- Purchase a 30-year policy with a $200,000 death benefit

- Purchase a 20-year policy with a $300,000 death benefit

- Purchase a 10-year policy with a $500,000 death benefit

These policy purchases line up with the time periods that John has determined his debts and mortgage would be paid and therefore he would need less life insurance coverage. Plus, the laddered policies will have a substantial effect on how much John has to pay in premiums over the next 30 years.

>>During the first 10 years of the life insurance ladder, John will be paying $53.10 per month for all three insurance policies and a $1mil death benefit.

>>During the second 10 years of the ladder, John will only be paying $38.42 for two of the insurance policies and a $500,000 death benefit.

>>During the third 10 years of the ladder, John will only be paying $21.71 for the remaining insurance policy and a $200,000 death benefit.

By laddering his coverage, John will save $11,533 because he will not be paying for coverage he doesn’t need.

What are the Downsides?

Ladder strategies certainly aren’t for everyone. Since multiple policies are involved there is a little more time and effort spent shopping for term life insurance coverage and having multiple policies issued. As far as service is concerned, a good insurance professional will make sure that you understand how service tasks are multiplied but your agent should be more than happy to help you with things like beneficiary changes when you ladder life insurance.

Often, life insurance companies will not allow you to purchase more than one policy at a time. This means you will have to work a little harder in order to get the policies going. You will also need to deal with multiple insurance premiums rather than just one payment at a time. The downside of this is that if something were to happen to your health early on, that would mean that the family left behind would need more money from a more significant life insurance policy to live comfortably for the years ahead.

Yes, if you should die unexpectedly in the first 10 or twenty years, your executor, attorney, or beneficiary will need to file multiple claims and present multiple death certificates. When you consider these issues, the fact that you’re saving thousands of dollars on your term life insurance policy should certainly remedy any additional aggravation.

For more information about life insurance laddering and whether it would work best for you, call the professionals at LifeInsure.com. You can reach LifeInsure.com at (866 )868-0099 during normal business hours, or contact us through our website at your convenience.

Conclusion

Life insurance laddering is a strategic approach that allows policyholders to tailor their coverage to meet changing financial needs over time. By combining multiple policies with staggered term lengths, laddering ensures that coverage gradually decreases as dependents become financially independent, debts are paid down, and retirement savings grow. This method not only provides adequate coverage when it’s most needed but can also lead to significant cost savings compared to maintaining a single high-value policy throughout one’s life.

Laddering life insurance policies offers a flexible, cost-effective solution for people with evolving financial responsibilities. This strategy allows you to optimize coverage for different stages of life, aligning your insurance with your unique needs and financial goals. If you’re considering laddering, consulting with a financial advisor can help you design a plan that balances affordability and protection, giving you peace of mind as your life circumstances change.

Companies we Recommend for Term Life Insurance Policies

Frequently Asked Questions

Laddering life insurance is a strategy where you take out multiple life insurance policies with different coverage amounts and term lengths to match your changing life stages and financial obligations.

The ladder life strategy involves purchasing several term life policies, like a 10-year term policy, a 20-year term policy, and even a 30-year term policy, to ensure you have the right coverage at the right time without overpaying on premiums.

By laddering your life insurance, you can save on life insurance premiums while ensuring that you have the right amount of coverage when you need it most. It allows for flexibility as your financial obligations change over time.

You can use a life insurance calculator to get an estimate of how much life insurance coverage you need based on your financial obligations, dependents, and future goals. This will help you decide how to ladder your life insurance effectively.

Yes! You can ladder different types of life insurance, like combining term life policies with a permanent life insurance policy, to create a tailored approach that suits your financial needs and goals.

While laddering can save you money, it may not be ideal for everyone. Some people may find it complex to manage multiple policies, and if you don’t keep track of them, you might end up with insufficient coverage at some point.

By using the ladder strategy, you can choose policies with shorter terms for the times you need more coverage, which helps you avoid paying for unnecessary permanent life insurance that you may not need right now.

Term Life Insurance Quotes

Last Updated on November 4, 2024 by Sonny O'Steen