Did you know over 60 million Americans are on Medicare? This program is for people 65 and older, or those with certain disabilities. It’s key to know about Medicare Supplement plans to cover what Original Medicare doesn’t.

We’ll explore UnitedHealthcare Medicare Supplement plans, also called Medigap plans. These plans help with healthcare costs not covered by Original Medicare. You’ll learn how they work with Original Medicare, the different options, and benefits. This will help you understand these important insurance policies.

We are not UnitedHealthcare. If you need to contact them, please call them at 1-800-523-5800 or contact them through their website.

What are UnitedHealthcare Medicare Supplement Plans?

UnitedHealthcare Medicare Supplement plans, also known as Medigap plans, are special insurance policies. They help cover some costs not paid by Original Medicare (Parts A and B). These plans work with your Original Medicare to pay for things like deductibles, coinsurance, and copayments.

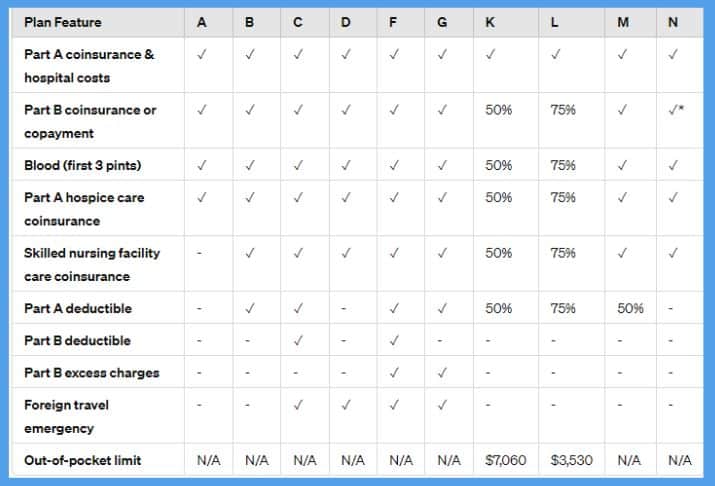

Medicare Supplement plans are standardized by the federal government. This means the benefits and coverage of different plan types (Plans A, B, C, D, F, G, K, L, M, and N) are the same, no matter the insurance company. This makes it easier for you to compare plans and pick the one that suits your healthcare needs and budget.

UnitedHealthcare is a top provider of Medicare Supplement plans. They offer a variety of plan options to help you manage your healthcare costs and get the care you need. With a UnitedHealthcare Medicare Supplement plan, you can enjoy predictable and affordable healthcare expenses.

How Medicare Supplement Plans Work with Original Medicare

Medicare supplement plans, also known as Medigap plans, work well with your Original Medicare (Parts A and B). These plans help cover costs that Original Medicare doesn’t pay, like deductibles and copayments.

With a Medicare supplement plan, you keep using your Original Medicare benefits. Then, your Medigap plan pays part of the costs not covered by Original Medicare. This gives you predictable and comprehensive coverage, keeping you safe from unexpected medical bills.

Medicare supplement plans offer many benefits, like covering the Part A deductible and extra hospital days. By adding a Medigap plan to your Original Medicare, you get better financial protection and peace of mind for your healthcare needs.

Predictable Costs with a Medicare Supplement Plan

Choosing a Medicare supplement plan, also known as Medigap, can help you manage your healthcare costs. These plans offer predictable out-of-pocket costs. This means you won’t face unexpected medical bills.

These plans have no network restrictions. So, you can see any doctor or specialist who accepts Medicare patients. You won’t need a referral to get care.

A Medicare Supplement plan brings peace of mind. It covers part of the out-of-pocket costs not paid by Original Medicare. This can help you avoid high medical bills. It’s great for people with chronic health conditions or needing frequent medical care. You won’t be surprised by medical bills.

With a Medicare Supplement plan, you can choose your healthcare providers freely. This is great if you travel a lot or live in different places. You’ll always have consistent coverage.

In the end, a Medicare Supplement plan gives you predictable costs and the freedom to choose your healthcare providers. This lets you navigate your healthcare journey with confidence.

UnitedHealthcare Medicare Supplement Plans

UnitedHealthcare is a top provider of Medicare Supplement (Medigap) plans. These plans help cover some costs not paid by Original Medicare. They offer predictable and comprehensive coverage, giving you peace of mind about healthcare costs.

UnitedHealthcare’s Medicare Supplement plans have many benefits. They cover Part A deductibles, Part B coinsurance, and extra hospital days. This can help you manage your healthcare costs and avoid surprise medical bills. You can visit any doctor or specialist who accepts Medicare patients without needing a referral.

No matter your healthcare needs, UnitedHealthcare has a plan for you. By picking a plan that fits your budget and preferences, you get predictable out-of-pocket costs. You also get the freedom to access the care you need.

Coverage and Benefits

Medicare Supplement plans, also known as Medigap plans, offer extra coverage beyond Original Medicare (Parts A and B). They help pay for costs like the Medicare Part A deductible, Part B coinsurance, and extra hospital days. These costs aren’t fully covered by Original Medicare.

When you sign up for a Medicare Supplement plan, you get peace of mind. You won’t worry as much about medical bills. These plans cover many benefits. This lets you control your healthcare costs and get the care you need without financial stress.

Key Benefits of Medicare Supplement Plans

| Benefit | Description |

|---|---|

| Part A Deductible | Medicare Supplement plans cover the Part A deductible. This is the amount you pay before Medicare starts paying its part. |

| Part B Coinsurance | These plans help pay for the coinsurance of outpatient services under Part B of Medicare. |

| Additional Hospital Days | Medicare Supplement plans may cover extra hospital days not covered by Original Medicare. This gives you more support during long hospital stays. |

Understanding Medicare Supplement plans and their benefits helps you make a smart choice for your health and finances. These plans offer great protection. They let you get the medical services you need without worrying about unexpected costs.

Enrolling in a Medicare Supplement Plan

Choosing the right time to enroll in a Medicare supplement (also known as Medigap) plan is key. The best time is during your Medicare Supplement Open Enrollment period. This period starts on the first day of the month when you’re 65 or older and enrolled in Medicare Part B.

Some states have extra Open Enrollment periods and Guaranteed Issue rules. It’s vital to know these rules in your area. If you apply outside these times, you might be denied or charged more because of your health history.

To make enrolling easy, review your Medicare supplement options. Pick a plan that meets your healthcare needs and budget. This way, you’ll have predictable out-of-pocket costs and can see any doctor or specialist without a referral.

Nationwide Coverage and Portability

Having a Medicare Supplement or Medigap plan is key for your health. These plans let you see any doctor or specialist without needing a referral. This means you can get the care you need, anywhere in the United States.

The UnitedHealthcare Medicare Supplement plans cover you everywhere you go. If you’re visiting family, exploring, or getting special treatment, your plan is with you. This gives you peace of mind to focus on your health.

These plans are also portable. Your Medicare Supplement coverage doesn’t depend on where you live or the healthcare network. So, if you move, you won’t have to change plans or doctors.

With UnitedHealthcare Medicare Supplement plans, you’re covered no matter where you go. You can get the care you need, on your terms. Enjoy the freedom that comes with nationwide coverage and portability.

Combining with Medicare Part D

Combining a Medicare Supplement (Medigap) plan with a Medicare Part D plan gives you the best coverage. Your Medicare Supplement plan covers out-of-pocket costs for medical services. A Part D plan helps with your prescription medication costs, giving you more financial security.

Medicare Supplement plans work with Original Medicare (Parts A and B). They help pay for costs that Medicare doesn’t cover, like deductibles and copayments. Adding a Medicare Part D plan to your coverage means you get more protection for your medical and prescription drug needs.

Having both a Medicare Supplement plan and a Medicare Part D plan means your medical and prescription drug costs are well-covered. This can prevent unexpected expenses and help you manage your healthcare better. It lets you focus on your health and well-being.

Guaranteed Renewable Coverage

Having reliable healthcare coverage is key. UnitedHealthcare Medicare Supplement plans, or Medigap plans, offer this. They give you coverage that lasts for life, as long as you pay your premiums and don’t lie on your application.

This means you can rest easy, knowing your healthcare plan will always be there for you. Unlike some plans that might cancel or raise rates as you get older, UnitedHealthcare’s Medicare Supplement plans stay with you. This gives you the peace of mind you deserve.

UnitedHealthcare’s Medicare Supplement plans are known for their reliability. They let you plan for the future without worry. You can be sure your Medicare Supplement plan will be there for you, supporting your health needs for years to come.

Value-Added Benefits and Discounts

Joining a UnitedHealthcare Medicare Supplement plan gives you more than just basic coverage. You get extra benefits and discounts that make your healthcare better. These extras help you save money and get more from your plan.

One great perk is a free gym membership. It lets you stay fit and enjoy fitness programs and facilities. You also get discounts on dental, hearing, and vision care. This helps you manage costs for important health services.

UnitedHealthcare Medicare Supplement plans offer big benefits and savings. These extras help you cover more costs and get better care. They can save you money on your healthcare bills.

| Value-Added Benefits | Description |

|---|---|

| Gym Membership | Access to a nationwide network of fitness centers at no additional cost |

| Dental Discounts | Discounted rates on a variety of dental services, including cleanings, fillings, and more |

| Hearing Discounts | Savings on hearing aids and other hearing-related products and services |

| Vision Discounts | Discounts on eye exams, glasses, and contact lenses |

With these benefits and discounts, your healthcare experience with UnitedHealthcare Medicare Supplement is better. You get more for your money.

Conclusion

UnitedHealthcare Medicare Supplement plans are a great choice for those wanting more coverage than Original Medicare. They help cover out-of-pocket costs. This means you’ll have more predictable healthcare expenses and the freedom to pick your healthcare providers anywhere in the country.

Learning about the benefits and how to enroll can help you find the right plan from UnitedHealthcare for your health needs and budget. These plans cover many out-of-pocket costs. This includes Part A deductibles, Part B coinsurance, and extra hospital days, among other things.

With UnitedHealthcare’s Medicare Supplement plans, you get the peace of mind that comes with knowing your healthcare costs are predictable. You can see any doctor or specialist who accepts Medicare patients without needing a referral. If you want to improve your Medicare coverage or control your healthcare costs better, consider UnitedHealthcare’s Medicare Supplement plans.

Frequently Asked Questions About UHC

A Medicare Supplement Insurance Plan, often referred to as Medigap, is designed to cover some of the costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles. These plans are sold by private companies and can complement your Medicare coverage.

An AARP Medicare Supplement Plan is a specific type of Medicare Supplement Insurance plan endorsed by AARP and provided by UnitedHealthcare. These plans offer various options to help fill the gaps in Original Medicare, making healthcare more affordable for seniors.

Choosing a Medicare Supplement Plan involves assessing your current health needs, reviewing the different plan options available, and considering factors like coverage, costs, and provider networks. You can also learn about Medicare Supplement plans through resources provided by AARP or your insurance broker.

Medicare Advantage plans, offered by private insurance companies, provide an alternative way to receive Medicare benefits and often include additional services like vision and dental coverage. In contrast, Medicare Supplement Insurance plans work alongside Original Medicare to cover out-of-pocket costs.

Yes, AARP Medicare Supplement Plans are insured by UnitedHealthcare Insurance Company. These plans are designed to help cover costs associated with Medicare and are endorsed by AARP for their commitment to providing quality insurance products.

To get more information about Medicare Supplement Plans and a free plan pricing comparison, call our Medicare specialists at (866) 868-0099 or contact us through our website.

Last Updated on August 20, 2024 by Richard Reich