Did you know Medicare Supplement Plan N was a top choice for Medicare recipients in 2021? It had over 1.3 million people enrolled. This plan helps cover gaps in your Original Medicare (Parts A and B) coverage. It could save you thousands in out-of-pocket costs.

When looking at Medicare options, knowing about Plan N can guide your choice. We’ll look into its main features, benefits, and costs. This way, you can see if it meets your healthcare needs.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N is a type of Medigap policy. It offers extra coverage beyond Original Medicare (Parts A and B). This plan helps cover some costs like deductibles, copayments, and coinsurance. With Plan N, you get more comprehensive healthcare coverage and lower medical costs.

Key Features of Plan N

Medicare Supplement Plan N has several key features. It covers 100% of Medicare Part A coinsurance and pays for the first three pints of blood for a procedure. It also covers Part B coinsurance, except for a $20 copayment for office visits and a $50 copayment for emergency room visits that don’t lead to hospital admission.

Plan N covers skilled nursing facility care, foreign travel emergency care, and more. This plan helps you avoid high out-of-pocket costs with Original Medicare. It gives you financial protection and peace of mind.

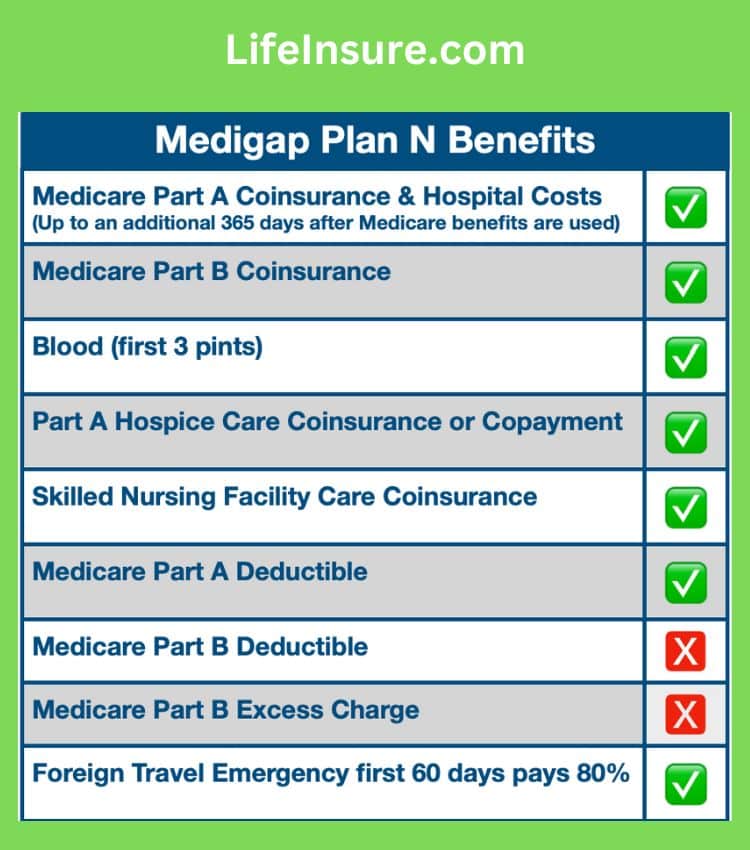

Medicare Supplement Plan N Benefits

If you’re on Original Medicare, Medicare Supplement Plan N can help with some costs. This plan is a top choice for many Medicare users in the U.S. It offers full coverage, making it a smart pick for many.

Plan N covers the Medicare Part A coinsurance, which is what you pay for services and hospital stays. It also covers the Part B coinsurance for outpatient care. This means you pay less for doctor visits and other outpatient services.

Plan N also covers the Medicare Part A deductible and hospital stays up to 365 days after your Medicare benefits end. It covers skilled nursing facility care and foreign travel emergency services too.

But, Plan N doesn’t cover the Medicare Part B deductible or excess charges. Still, it might be a good deal for those wanting full coverage at a lower monthly cost than other Medigap plans. Remember, you’ll pay a $20 copay for doctor visits and $50 for emergency room visits not leading to hospital admission.

How Much Does Plan N Cost?

The cost of Medicare Supplement Plan N varies. On average, it costs between $80 to $100 each month. But, your actual cost could be more or less. This depends on your location, age, gender, health, and other factors.

Factors Affecting Plan N Premiums

Your age affects the cost of Plan N. Premiums are lower for younger people and go up as you get older. For instance, in 2023, the average monthly cost for Plan N is $100.57 at age 66 and $173.83 at age 85.

Where you live also plays a role in the cost. Premiums can change based on the cost of living and healthcare in your area. If you use tobacco products, you’ll pay more for your Plan N coverage.

Other things that can change the price of Plan N include your gender, health, and the pricing models used by insurance companies. It’s smart to compare quotes from different providers to find the best rate for you.

Comparing Plan N to Other Medigap Plans

When looking at Medicare Supplement Plan N versus other Medigap plans, there are some key differences. Plan N usually has lower monthly premiums than plans like Plan G. But, it also has some extra out-of-pocket costs.

For instance, Plan N requires copayments of up to $20 for doctor visits and up to $50 for emergency room visits that don’t lead to hospital admission. Plan G, on the other hand, covers 100% of the Medicare Part B coinsurance with no copays. For a 65-year-old nonsmoker in Atlanta, Plan N costs $29 less per month than Plan G.

Also, Plan G covers Medicare Part B excess charges. These are the charges above what Medicare has approved. Plan N doesn’t cover these charges, which could mean higher costs for the policyholder.

Even with these differences, both Plan N and Plan G cover important benefits. These include Medicare Part A coinsurance, skilled nursing facility care, and foreign travel emergency care. Plan N might be a good choice for those wanting lower premiums and some extra cost-sharing. Plan G offers more comprehensive coverage with predictable costs.

Who Should Consider Plan N?

Medicare Supplement Plan N is great for those on a tight budget but still want good coverage. It offers lower monthly premiums than plans like Plan G. This can help you save money while still covering many of your medical costs.

But, think about the trade-offs of Plan N. You’ll pay less each month, but you’ll have to pay the Medicare Part B deductible and small copays for doctor visits and ER trips. Also, Plan N doesn’t cover Part B excess charges. This means you could pay up to 15% more if a doctor charges too much. If you’re okay with higher copays and want to save money, Plan N might be right for you.

Choosing Plan N depends on your money situation, health needs, and what you prefer. It’s smart to look at all your options, think about your future medical costs, and talk to a licensed insurance agent. This way, you can see if Plan N fits your Medicare needs and budget.

Plan N Frequently Asked Quesitons

What is Medicare Supplement Plan N?

Medicare Supplement Plan N is a type of Medigap plan in the U.S. It covers many services like hospital stays, doctor visits, blood, and hospice care. This plan helps fill the gaps in Original Medicare (Parts A and B) by paying for deductibles, coinsurance, and copayments.

What are the key features of Plan N?

Plan N has several key features: – It helps cover deductibles, coinsurance, and copayments not paid by Original Medicare. – It offers comprehensive benefits at a lower cost than other plans like Plan F or Plan G. – It covers 100% of Medicare Part A coinsurance and hospital costs for up to 365 days after Medicare runs out. – It covers Part B coinsurance, except for a copayment for some visits to the doctor or emergency room.

What benefits does Medicare Supplement Plan N provide?

Plan N offers many benefits: – It covers 100% of Medicare Part A coinsurance and hospital costs for up to 365 days after Medicare ends. – It covers Part B coinsurance, except for a copayment for some doctor visits and emergency room visits. – It covers 100% of the Part A deductible. – It covers 100% of Part B excess charges. – It covers the first 3 pints of blood each year. – It covers 100% of Part A hospice care coinsurance or copayment.

How much does Medicare Supplement Plan N cost?

The cost of Plan N varies based on several factors: – Your age, gender, and location – Whether you smoke – The insurance company offering the plan – The plan’s deductibles and copayments – Your health status

Plan N premiums are usually lower than those for more comprehensive plans like Plan F or Plan G.

How does Plan N compare to other Medigap plans?

Plan N differs from other Medigap plans in a few ways: – It has lower premiums than plans like Plan F or Plan G. – It requires a copayment for some doctor visits and emergency room visits that don’t lead to hospital admission. – It doesn’t cover the Medicare Part B deductible, unlike Plans F and G. – It is the third most popular Medigap plan, after Plans F and G.

To get more information about Medicare Supplement Plans and a free plan pricing comparison, call our Medicare specialists at (866) 868-0099 or contact us through our website.

Last Updated on July 31, 2024 by Richard Reich