An error encountered loading your Dappier widget.

Please make sure you have configured your widget correctly.

Are you thinking about Medicare Supplement Plan F but not sure about costs and coverage? Exploring this option in the world of Medicare is important. It helps you understand the benefits and costs. This detailed guide can help you figure out if Plan F matches what you need. It also helps you to see if it’s affordable for you.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is a comprehensive Medigap plan. It fills the gaps in your Original Medicare. With this plan, you get extra benefits. This means more financial protection and less worry about healthcare costs.

Coverage Details

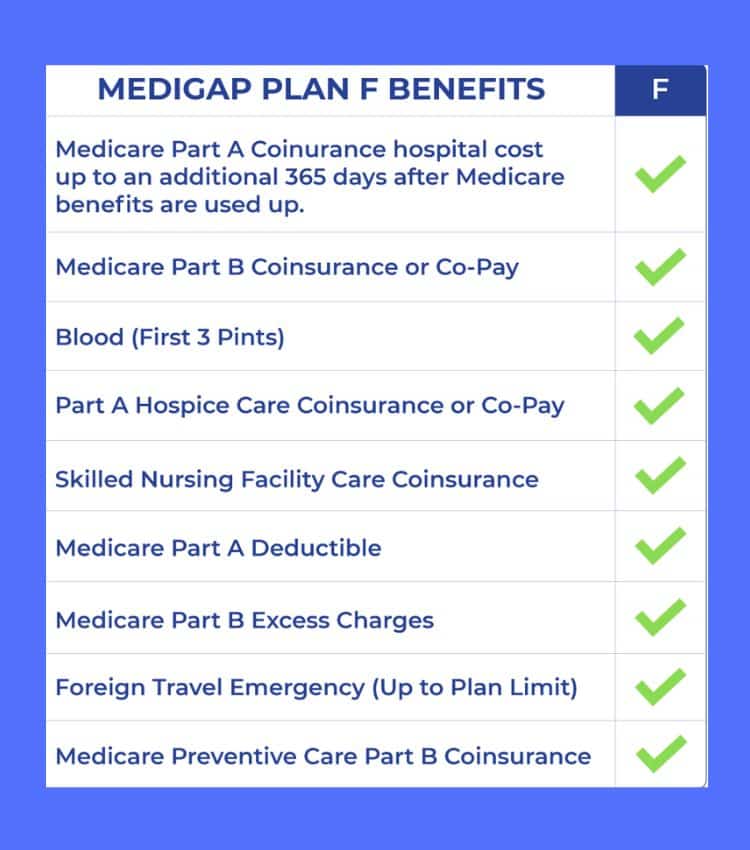

Plan F covers a lot, such as Part A coinsurance for hospital stays and costs past your Medicare benefits. It handles Part B coinsurance or copayment, the blood benefit for the first 3 pints, and more.

This protection cuts down on your out-of-pocket expenses. It gives you the coverage you need.

Eligibility Requirements

If you want Medicare Supplement Plan F, you need Medicare Part A and Part B. It’s for people 65 or older, and those younger with a disability or End-Stage Renal Disease. Remember, if you turned 65 after January 1, 2020, you can’t get Plan F.

Comparison with Other Medigap Plans

Plan F has the most coverage of any Medigap plan. But, you might find Plan G or Plan N better for your budget and healthcare needs. It’s important to look at different Medicare Supplement insurance plans. This way, you can pick the one that works best for your health and wallet.

Costs of Medicare Supplement Plan F

One big thing to think about with Medicare Supplement Plan F is its costs. These include the premiums you pay and other factors that might change how much you pay. It’s important to look at discounts and ways to save money to lower your costs.

Premiums and Pricing Factors

The cost of Medigap can be different from one insurance company to another. It can also change based on the plan and where you live. Each company can decide its prices. This can affect both current and future costs. Even though the benefits in Plan F are the same no matter the company, the price you pay might vary if you get the same Plan F from a different company.

Your age, gender, if you use tobacco, and where you live can affect the price of Plan F. Insurers might also look at your health and past medical issues. This could make your premium higher.

Discounts and Cost-Saving Options

Some insurance companies might give you discounts or ways to save money on your Plan F. This could be for signing up for automatic payments, not smoking, or if you’re part of certain groups. If you and someone else in your house both get a Medigap policy, you might also get a discount.

It’s smart to look at the price and any discounts closely when comparing different Plan F options. By looking into what affects the price and finding ways to save, you can pick the best coverage for your budget.

Medicare Supplement Plan F

Medicare Supplement Plan F is a complete Medigap plan. It fills in the gaps in your Original Medicare. It gives you many benefits to lower your extra costs and keep you financially secure.

Benefits of Plan F Coverage

Plan F gives you peace of mind and extra coverage. It helps with Part A coinsurance and hospital costs for 365 more days. It also covers Part B coinsurance or copays, the blood benefit for the first 3 pints, and more. This means less worry about medical bills.

Out-of-Pocket Expenses Covered

Plan F takes care of many costs that Original Medicare doesn’t. It covers Part A and Part B deductibles, and coinsurance or copays too. This gives you full financial safety.

Choosing the Right Medicare Supplement Plan

Choosing the right Medicare supplement plan in retirement is key. Whether you’re thinking about Plan F or other options, look at your health needs. Compare plans to see which one fits best.

Evaluating Your Healthcare Needs

First, think about your health now and later. Look at your age, health, and any long-term conditions. Decide how often you see the doctor. This helps figure out your coverage and what you’ll pay.

Comparing Plan Options

After knowing what you need, check the different Medigap plans like G, N, and F. See what they cover and how much they cost. Remember, what each plan covers is the same, but prices can change a lot.

Think about if you might get a discount or if you have to see certain doctors. Look at every detail to pick the plan that meets your health needs and pocket best.

Enrolling in Medicare Supplement Plan F

If you want to join Medicare Supplement Plan F, understanding when and how is key. This plan helps pay for costs Medicare doesn’t cover. It’s mainly for those 65 years old and up who have Medicare Parts A and B. Younger folks with certain health problems may join too.

Enrollment Periods and Deadlines

Joining a Plan F is easiest during your Medigap Open Enrollment Period. For most, this lasts 6 months starting when you turn 65 and get Part B. In these first months, you can sign up without a health check.

If you miss your Open Enrollment Period, signing up might be harder. You might need to answer questions about your health. And, the cost could be higher based on your health history.

Application Process

To start with Plan F, you must fill out an application. You’ll give your info and answer some health questions. Different states and companies might ask for other details. After they approve you, you choose your start date and start paying.

Remember, how you sign up can change based on where you live and the company you choose. Be ready to check what’s needed ahead of time.

Additional Considerations for Plan F

When you look into Medicare Supplement Plan F, remember a few extra things. There are limits for pre-existing conditions. Also, think about how this plan works with any other health insurance you might have.

Pre-Existing Condition Limitations

Medicare Supplement Plan F could have limits for pre-existing conditions. This means it might not pay for treatment of health issues you had before getting the plan. Different insurance companies may have their own rules. So, always check this out closely when you’re looking at Plan F options.

Coordination with Other Insurance

If you get insurance through your job or a retiree plan, know how Plan F and these other insurances work together. Plan F might help cover what your other plans don’t. This can lower your costs. But, make sure to understand the rules so you don’t miss out on coverage or pay twice.

Conclusion

This article gave a deep look at Medicare Supplement Plan F. It talked about what it covers, who can get it, how much it costs, and how it stands compared to other plans. Plan F helps with a lot of costs you’d normally pay yourself, like the deductible.

But, keep in mind, if you turned 65 after January 1, 2020, you can’t sign up for it. When choosing your Medicare plan, think about what you need and match it to the available plans. Important factors are the price, any deals you might get, and if they cover your health issues.

Learning about when and how to sign up is also key. It makes switching to a new Medicare Supplement plan a lot easier. Remember, the Medicare plan options are always changing. Keeping up and looking at all your choices will help you choose a plan that’s right for you. It will protect you and make you feel secure during your golden years.

Medigap Plan F Frequently asked Questions

Medigap Plan F is a Medicare supplement insurance plan that helps cover certain out-of-pocket costs that are not covered by Original Medicare, including deductibles, co-payments, and co-insurance.

Medigap Plan F covers a wide range of expenses, such as Part A and Part B deductibles, Part B coinsurance, hospital costs, skilled nursing facility costs, outpatient services, and more. However, please note that Medigap Plan F does not cover prescription drugs.

To be eligible for Medigap Plan F, you must be enrolled in Medicare Part A and Part B. It’s important to note that Plan F is no longer available in Medicare on or after January 1, 2020.

Medigap Plan F and G are similar in coverage, but the main difference is that Plan F covers the Medicare Part B deductible. Plan F is being phased out for new enrollees, whereas Plan G remains available.

The Medicare Part B deductible is an out-of-pocket cost that Medicare recipients are required to pay before Medicare starts paying its share of the costs. Currently, no Medicare Supplement Plan covers the Part B deductible unless you purchase Plan F before January 1, 2020, and have continued to renew it.

If you were enrolled in Medigap Plan F before it was discontinued for new enrollees, you may keep your plan. However, the availability may vary depending on the regulations in your state.

To get more information about Medicare Supplement Plans (Medigap) and Medicare Part D, we encourage you to click on the quote button in this article, call us at (866) 868-0099, or contact us through our website 24/7

Last Updated on August 5, 2024 by Sonny O'Steen