Medicare Supplement Plan D gives you a lot of coverage. It helps lower what you pay at the doctor’s office. This includes help with hospital stays, doctor visits, blood needs, and even hospice care.

Understanding Medicare Supplement Plans

Medicare Supplement plans are private policies called Medigap. They fill gaps in Original Medicare. These plans lower out-of-pocket costs for things like deductibles.

One good option is Medicare Supplement Plan D. It gives big coverage for a low price. You get more benefits and save money on healthcare.

Insurance companies offer these plans. They boost your Medicare and give full coverage for health. Medigap plans give you more peace about your health costs.

Choosing a Medicare Supplement plan means less worrying. You get extra help with bills and a plan for unexpected costs. It’s a way to stay financially safe.

Benefits of Medicare Supplement Plan D

Medicare Supplement Plan D has many good things for you. It can make your Medicare better. And it can give you peace about your health costs.

One big plus of Plan D is it pays the Part B deductible for you. This is what you pay first before Medicare helps with costs. So, with Plan D, you don’t worry about paying this with your own money.

Plan D also helps with the Part B excess charge. This is when doctors can charge more than what Medicare allows. Plan D keeps you from paying these extra costs.

If you go out of the U.S., Plan D has you covered for medical emergencies. This is very important if you need a doctor in another country. Having this helps make sure you get help and are safe while traveling.

Also, Plan D sets an out-of-pocket limit on what you spend each year. Once you hit this limit, your costs for covered services are fully paid. This limit protects you from spending too much on healthcare.

In the end, Plan D does a lot to improve your Medicare. It handles the Part B costs, covers travel emergencies, and caps your yearly spending. Plan D makes sure you are well covered and saves you from big healthcare bills.

| Benefit | Medigap Plan D Coverage |

|---|---|

| Medicare Part A Coinsurance and Hospital Costs | 100% |

| Medicare Part B Coinsurance or Copayment | 100% |

| First 3 Pints of Blood | 100% |

| Part A Hospice Care Coinsurance or Copayment | 100% |

| Skilled Nursing Facility Care Coinsurance | 100% |

| Medicare Part A Deductible | 100% |

| Medicare Part B Deductible | Not Covered |

| Medicare Part B Excess Charges | Not Covered |

| Foreign Travel Emergency (up to plan limits) | 80% |

This table provides a clear overview of what is covered under Medigap Plan D. If you need further details or any modifications, feel free to call us at (866) 868-0099.

Comparing Medicare Supplement Plans

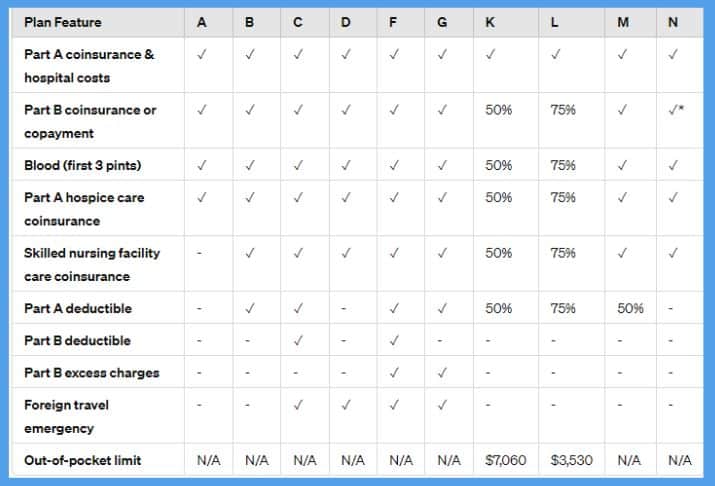

It’s important to look closely at Medicare Supplement plans. Look at the cost and what they cover. Even though all plans offer the same benefits, the price can be different. Medigap plans like Medicare Supplement Plan D have varying costs.

Want to find a good Medicare Supplement plan? Start by checking out the costs and what each covers. Look at different Medigap plans and their prices. This way, you’ll pick the one that fits your budget.

Think about what medical help you might need. A plan that covers a lot might cost more. But, it will also give you more benefits.

Remember to consider your budget before choosing a plan. You need a plan that doesn’t cost too much. But make sure it covers what you need. Comparing plans will help you find the right one for you.

Factors Affecting Medigap Costs

When you look at Medicare Supplement Plan D, several things can change the cost. Knowing these factors helps you make a good healthcare choice. There are key things that decide the cost of Medigap plans:

Open Enrollment Period

In the first six months after you turn 65 and sign up for Medicare Part B, it’s your chance to get a Medigap plan with no health questions asked. This is your Medigap open enrollment period. Premiums are usually lower during this time.

Location

Where you live affects how much Medigap will cost. Rules vary by state. Some let insurance companies set their own prices, while some use the same price for all. Know your state’s rules when checking different Medigap plans.

Age and Gender

How old you are and if you are a man or a woman can change Medigap plan costs too. Older people may pay more. Some companies offer discounts for being a certain age or gender.

For instance, women might pay less than men. Or, older folks might get a discount. Always ask about any available discounts to cut down your Medigap costs.

What you learn about these factors can guide your decisions on Medigap costs. Use your open enrollment period smartly. Pay attention to rules about prices in your state. Look into any discounts related to age or gender. This way, you can make a smarter choice for your health coverage.

Saving Money on Medicare Supplement Insurance

Want to spend less on your Medicare Supplement insurance? There are many ways to do this. You can use special entry times, look at different plan types, and compare costs to cut your Medigap bill and keep great coverage.

Medigap Open Enrollment

Getting a good deal often starts with the Medigap open enrollment period. It lasts for six months after you’re 65 and sign up for Medicare Part B. During this time, you can pick any Medigap plan without worrying about your health. Insurance companies can’t charge you more or say no.

Discounts and Incentives

Some insurers give discounts on Medigap for certain things. For instance, if you don’t smoke, are a specific gender, or have more people in your plan, you might pay less. These deals can bring down your costs and make your insurance more budget-friendly.

High-Deductible Options

High-deductible Medigap plans are another choice. These plans have lower monthly payments but a higher starting cost when you need care. If you’re healthy and don’t see the doctor often, this could save you money without losing out on coverage.

Medicare SELECT Policies

Medicare SELECT is a network-based Medigap plan. You have to use certain hospitals and doctors. These plans often cost less than regular Medigap. If your favorite healthcare providers are in the network, going with a SELECT plan can cut your premium costs.

Comparing Quotes

Before you buy a Medigap plan, it’s smart to check prices from different companies. Costs can be very different. Comparing quotes can help you find the best offer. This way, you get the most for your money and may pay less for your Medigap.

Take advantage of Medigap enrollment times, look for discounts and high-deductible plans, check out Medigap SELECT, and compare quotes. These steps can help you spend less on your Medicare Supplement without giving up good coverage. Do your homework to make an educated choice that matches your needs and wallet.

Understanding Medigap Pricing

Thinking about a Medicare Supplement Plan D? It’s key to know how Medigap policies are priced. Prices for Medigap can change due to the company’s method.

The first way, community-rated pricing, means everyone with the same policy pays the same. Age doesn’t matter for your cost, which makes it easier to plan your budget.

Issue-age-rated pricing ties the premium to your policy start age. If you start younger, you usually pay less. So, this can save money for those who get a policy early.

Then there’s attained-age-rated pricing. Here, your premium goes up with your age. Starting lower, these costs can go up over time as you grow older.

Knowing how Medigap premiums work is crucial for a Medicare Supplement Plan D. It’s smart to check all pricing types and think about future costs. Also, ask about any discounts that could lower your Medigap policy cost.

Conclusion

Medicare Supplement Plan D is great for those wanting to lower out-of-pocket costs. This plan helps cover what Original Medicare doesn’t, giving you peace of mind. Your health needs will be well taken care of.

This plan offers many benefits to help manage healthcare costs. It covers your Part B deductible and emergency services when you travel abroad. It also limits how much you have to pay out of pocket each year.

It’s important to know about the benefits and costs of Medigap plans. This knowledge helps you choose wisely. Medicare Supplement Plan D gives great coverage at good prices, making it a solid choice for your healthcare needs.

Medigap Plan D FAQs

Medicare Supplement Plan D adds more coverage to Original Medicare. It lowers out-of-pocket costs for various medical needs. This plan is a good choice for many people.

It includes Part A and Part B coinsurance or copayment. There’s also coverage for blood benefits and hospice care. You get help for skilled nursing care, Part B’s deductible, and more. It even covers you if you have a health emergency while traveling out of the country. Plan D sets a limit on yearly medical spending too.

Where you live, your age, if you’re a man or woman, and your health all play a part in cost. Prices might be lower if you buy at the right time. Discounts could be there for things like not smoking or family memberships.

Buying during the open enrollment period locks in good rates. Some companies offer deals for certain groups. You might also save by choosing a high-deductible plan or a Medicare SELECT policy.

To get more information about Medicare Supplement Plans and a free plan pricing comparison, call our Medicare specialists at (866) 868-0099 or contact us through our website.

Last Updated on August 31, 2024 by Richard Reich