Do you want to lower your healthcare costs with Medicare? Many people find that extra costs, like deductibles, can add up fast. Medicare Supplement Plan B, or Medigap Plan B, can help with this. It offers extra coverage beyond Original Medicare, covering big expenses like deductibles and copayments.

With Medigap Plan B, you get more help with your medical costs. This guide shows you how Plan B can make your health expenses easier to handle. Let’s look at the key benefits of having this plan.

Key Takeaways

- Medicare Supplement Plan B helps cover out-of-pocket expenses not paid by Original Medicare.

- This plan covers specific costs such as deductibles, copayments, and coinsurance.

- Medigap Plan B acts as a valuable addition to your health insurance, providing enhanced healthcare security.

- Enrolling in Medicare Supplement Plan B can substantially lower your medical expenses.

- Understanding the benefits of Plan B will aid in making informed decisions about your Medicare coverage.

Introduction to Medicare Supplement Plans

Medicare Supplement plans, or Medigap, are key to the United States Medicare system. They help by covering costs that Original Medicare does not. Understanding Medigap can make your health insurance work better for you.

These plans work alongside Parts A and B of Original Medicare. While Original Medicare helps with a lot of costs, there are still expenses like copayments not covered. Medigap helps lower these extra costs, so you don’t have to worry about large bills for your healthcare.

Adding a Medigap plan can make your healthcare costs more predictable and easier to manage. This means fewer surprises with your medical bills and more peace of mind. Knowing your costs are under control is a big relief.

Your Medigap plan must fit well with your current Medicare. Looking at different Medigap plans helps you find the one that suits you best. With many options to choose from, picking the right plan is a smart way to secure your health and finances.

By joining a Medigap plan with your Original Medicare, you can feel safer about your healthcare. A well-thought-out plan helps you worry less about money and more about staying healthy. It’s all about smart planning and selecting the best plan for you.

What Does Medicare Supplement Plan B Cover?

Medicare Supplement Plan B helps with costs Original Medicare doesn’t cover. It takes care of expenses that can become a burden. Let’s break down what this plan includes.

Part A Coinsurance and Hospital Costs

This plan fully covers Part A coinsurance and hospital expenses for up to a year more after Original Medicare stops. It stops big bills from piling up during longer hospital stays.

Part B Coinsurance or Copayment

Plan B pays for Part B coinsurance and copayments. It handles 100% of the costs for outpatient and doctor services. This keeps your costs low.

Blood (First 3 Pints)

This plan also includes the first three pints of blood each year. Original Medicare only helps after the first three. So, you get a break from covering these initial costs.

Part A Hospice Care Coinsurance or Copayment

For hospice care, it supports you by covering copayments and coinsurance. This support is vital for managing pain and symptoms, adding to the quality of care you receive.

Part A Deductible

Finally, it covers the Part A deductible. This is a big deal because it cuts the cost of hospital care. You won’t have to worry about this large upfront cost.

In short, Medicare Supplement Plan B is a strong option. It handles a wide range of costs related to staying in the hospital, seeing doctors, needing blood, or when in hospice care. Here’s a comparison of what it covers versus Original Medicare:

Coverage Area | Original Medicare | Medigap Plan B |

Part A Coinsurance | Yes (Up to a limit) | Yes (Plus 365 additional days) |

Hospital Costs After Part A Benefits | No | Yes |

Part B Coinsurance/Copayment | Yes (20%) | Yes (100%) |

Blood (First 3 Pints) | No | Yes |

Part A Hospice Care | Yes (Copayment required) | Yes (100%) |

Part A Deductible | No | Yes |

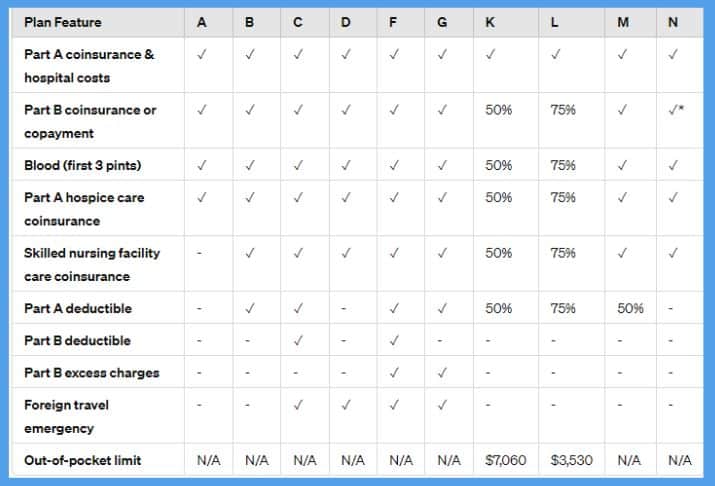

How Does Medicare Supplement Plan B Differ from Other Plans?

Knowing how Medigap Plan B stands out from other Medicare supplement insurance choices is important. Each Medigap plan enhances Original Medicare in different ways. This means they each provide unique benefits and coverage levels.

For example, Medigap Plan B covers key benefits. It includes Part A hospital coinsurance and adds more coverage for hospital costs for 365 days after Medicare stops. It also pays for the Part A deductible. This is great for people who often need hospital care.

Feature | Medigap Plan B | Other Popular Medigap Plans |

Part A Hospital Coinsurance | Covered | Covered in most plans |

Part A Deductible | Covered | Varies (mostly covered in plans F and G) |

Part B Coinsurance | Not Covered | Covered in plans F, G, N |

First 3 Pints of Blood | Covered | Covered in most plans |

Part B Excess Charges | Not Covered | Covered in plan G |

When picking a Medigap plan, look closely at what each plan covers. Medicare Plan B is good if you mainly worry about hospital bills and Part A deductibles. But if you need coverage for doctor visits and other outpatient costs, you might prefer other Medicare supplement insurance plans.

Compare Medigap plans carefully. Look at what each plan covers and costs. Consider your own healthcare and financial needs before choosing a plan. This process helps ensure you pick the one that fits you best.

Eligibility for Medicare Supplement Plan B

It’s important to know if you’re eligible for Medicare Supplement Plan B. We’ll cover the steps and requirements to help you understand your path.

Enrolling in Medicare Part A and Part B

First off, you need to sign up for Medicare Part A and Part B. Part A covers hospital visits, and Part B helps with doctor visits. These two parts are key for your Medicare coverage and work with Medigap plans to lower your costs.

Age Requirements

Most folks can get Medicare when they turn 65. This includes both Part A and Part B. If you’re under 65 but have certain disabilities, you might qualify too. Once you have Parts A and B, you can get a Medicare Supplement Plan.

Open Enrollment Period

The open enrollment for Medigap plans is important. It starts the month you’re 65 and have Medicare Part B. During the six months after this, you can buy any Medigap plan. You won’t be charged extra for health conditions.

Benefits of Choosing Medicare Supplement Plan B

Medicare Supplement Plan B offers big benefits for your healthcare costs. It cuts down on out-of-pocket costs, making medical bills less of a worry. This plan helps with costs from Medicare Part A and Part B, plus hospital stays. It lowers your unexpected expenses, bringing peace.

This plan is also good for preventive healthcare. It lets you get important screenings and services for better health. Catching health problems early saves time and money. It shows why choosing the right Medicare supplement insurance matters.

Medicare coverage from Plan B is great for hospital stays too. If you need to stay in the hospital longer, it helps for around 365 more days. This extra coverage for hospitalization stops you from facing huge bills for long treatments.

Here’s what you get with Medicare Supplement Plan B:

Benefit | Description |

Reduced Out-of-Pocket Costs | Covers copayments, coinsurance, and other expenses not covered by Original Medicare. |

Preventive Healthcare Emphasis | Prioritizes access to screenings and preventive services for better health. |

Extended Hospital Coverage | Offers an additional 365 days of hospitalization coverage beyond Original Medicare limits. |

Costs Associated with Medicare Supplement Plan B

It’s important to know the costs of Medicare Supplement Plan B to make smart choices. This includes looking at monthly premiums and out-of-pocket expenses. We’ll also see how Plan B compares to other Medigap plans.

Monthly Premiums

The monthly premium for Plan B changes based on a few factors. Your age, where you live, and your health all play a part. Insurance companies check your health when you apply. This can make your premium go up or down. Paying your premium is key. It makes sure your plan helps cover big healthcare bills like the Medicare Part B deductible.

Out-of-Pocket Costs

With Medigap Plan B, you pay costs not fully covered by Original Medicare. These costs might include coinsurance and some deductibles. The plan is good at helping with Part A coinsurance and long hospital stays. But, you’d still handle the Medicare Part B deductible. Knowing these costs helps keep your budget in check.

Comparison with Other Medigap Plans

Looking at different Medigap policies, you’ll find they offer different benefits. For example, Plan B doesn’t cover the Part B deductible, but some plans do. Choosing the right plan means checking what each covers, based on your health and needs.

Here’s a look at how these plans differ:

How to Enroll in Medicare Supplement Plan B

Getting Medicare Supplement Plan B at the right time is important. You should sign up during your first six months after turning 65. This period starts if you are also signed up for Medicare Part B.

If you enroll during the first six months after turning 65, you won’t face strict health questions. Insurance companies can’t refuse to cover you or make you pay more because you’re not in perfect health. This chance to sign up without problems is very important.

Here’s how you can start:

- Make sure you have both Medicare Part A and Part B. You need these to qualify for a Medicare Supplement Plan B.

- Look into different insurance companies that sell Medicare Supplement Plan B. Check their prices, how they are rated for service, and what their plans offer. Choose the one that’s right for you.

- Get in touch with the insurer you’ve picked. You can sign up online, by phone, or by stopping by their local office.

- Go over the details of your new policy for Medicare Supplement Plan B. Focus on what the plan covers, the costs, and any extra benefits you might get.

By taking these steps carefully, you make sure your move to Medicare Supplement Plan B is easy and good.

Here’s a table to help you remember what’s important when signing up for Medicare Supplement Plan B:

Key Aspect | Details |

Initial Enrollment Period | Six months after you are 65 and have signed up for Medicare Part B |

Eligibility Requirements | You must be signed up for Medicare Part A and Part B |

Important Considerations | Pay attention to the policy details, like what the premiums and benefits are |

Enrollment Methods | You can sign up by going online, calling, or visiting the insurance company in person |

Understanding the Basic Benefits of Medigap Plans

Medigap plans help cover extra healthcare costs not paid by Original Medicare. They give a standard level of benefits in each state. This makes benefits the same for everyone.

Standardized Benefits Across States

Medigap plans provide the same benefits no matter where you live. For example, benefits in California are the same as in Texas. This makes choosing a Medigap plan less confusing.

Coverage for Part A and Part B

Medigap plans help pay for many out-of-pocket costs of Medicare Part A and Part B. This includes costs for hospital stays, doctor visits, and the first three pints of blood each year. It can lower your costs and give you peace of mind.

Coverage for Emergency Care

Medigap plans can also cover emergency care, which is vital when abroad. Some plans even cover emergency medical care outside the U.S. This can be very helpful if you travel a lot. Be sure to check what each plan covers.

Medigap Plan | Part A Coverage | Part B Coverage | Emergency Care Coverage |

Plan A | Yes | Yes | No |

Plan B | Yes | Yes | No |

Plan C | Yes | Yes | Yes |

Plan F | Yes | Yes | Yes |

Comparing Medicare Supplement Plan B with Medicare Advantage

Understanding Medicare Supplement Plan B and Medicare Advantage plans is key. They both offer different benefits for various needs. However, they work quite differently.

Medicare Supplement Plan B works with Original Medicare to help pay for certain things. It covers some out-of-pocket costs, like copays and deductibles. This plan makes sure you have help paying these costs, so you don’t worry as much about your health care bills. It also allows you to see most doctors and go to many hospitals.

Medicare Advantage plans are not part of Original Medicare. They are plans from private insurance companies. These plans might include services not in Medicare Supplement Plan B, such as vision and dental care. But, you might be limited to which doctors and places you can use.

Here are some important things to think about when comparing these plans:

Feature | Medicare Supplement Plan B | Medicare Advantage |

Covers out-of-pocket costs | Yes | Varies by plan |

Choice of doctors | Any doctor who accepts Medicare | Limited to network providers |

Additional benefits (vision, dental, etc.) | No | Often included |

Need for medical necessity | Depends on Medicare guidelines | Determined by the plan |

Part of Original Medicare | Yes | No, replaces Original Medicare |

When deciding, consider your needs and what you want from a health plan. If having the choice to see any doctor is crucial, Plan B might be best for you. On the other hand, if you want extra things like vision or dental and don’t mind some rules about where to go, Advantage could be the right pick.

State-specific Information on Plan B

It’s important to know about Medicare Supplement Plan B in different states. This is key for an informed choice. We will dive into outlines for folks living in Massachusetts, Minnesota, and Wisconsin. They contain benefits and options specific to each state.

Medicare Supplement Plan B in Massachusetts

Massachusetts stands out with its unique Medigap policies. Here, everyone gets the same benefits thanks to state laws. With plans like Core and Supplement 1, your health costs can be kept lower.

Medicare Supplement Plan B in Minnesota

Minnesota has its own set of Medigap plans, like Basic and Extended Basic. These provide special coverage for the state’s health needs. Extra state-specific benefits make choosing the right Medigap plan easier here.

Medicare Supplement Plan B in Wisconsin

Wisconsin takes a flexible approach with Medigap policies. A Basic Plan is available, but you can add riders for more coverage. This flexibility is a big plus. It lets you customize your policy to fit your personal health situation, maximizing your benefits.

Conclusion

Looking at all the Medicare choices can be a lot to handle. But, Medigap Plan B can light the way to full coverage. It helps fill in the gaps left by Original Medicare, like paying for copays and deductibles. With Plan B, you can get peace of mind. You don’t have to worry so much about costs when you need to see a doctor or go to the hospital.

Picking the best extra plan is key. Medigap Plan B is a good pick for making your Medicare coverage better. It makes healthcare costs easier to understand. The sign-up process is simple once you’re eligible for Medicare. Working with experts in insurance makes choosing easier. They can help you pick the right plan for you.

In the end, Medigap Plan B stands out for adding to Medicare through a trusted insurance company. It focuses on lowering what you have to pay out-of-pocket. With these extra details, you can wisely choose your Medicare Supplement. This way, you get the right healthcare coverage you need.

Frequently Asked Questions

Medicare is a federal health insurance program for people aged 65 and older, as well as certain younger individuals with disabilities. It consists of different parts, such as Part A for hospital insurance and Part B for medical insurance. Medicare helps cover a range of healthcare services and costs.

A Medicare Supplement Plan B is a type of Medigap plan that helps cover certain costs that Original Medicare (Parts A and B) doesn’t cover. It can help pay for expenses like deductibles, coinsurance, and copayments.

Part B is a component of Medicare that covers medical services and outpatient care, while a Medicare Supplement Plan B is a type of insurance plan that works alongside Original Medicare to help cover certain out-of-pocket costs.

You should consider enrolling in a Medigap or Medicare Supplement Insurance plan during your open enrollment period to ensure you have access to the broadest range of options and benefits without restrictions or penalties.

Medicare Supplement Plans, also known as Medigap plans, can help fill the gaps in coverage left by Original Medicare, providing peace of mind by assisting with expenses such as deductibles, coinsurance, and out-of-pocket costs.

To get more information about Medicare Supplement Plans and a free plan pricing comparison, call our Medicare specialists at (866) 868-0099 or contact us through our website.

Last Updated on July 3, 2024 by Sonny O'Steen