No Exam Life Insurance Quotes

Have you noticed that almost every life insurance website is a little misleading about getting instant life insurance quotes? Most people find that once you’ve provided your email address or phone number, the race is on for agents to contact you until you demand that they just stop.

When you finally make a decision and start the application process, they immediately start talking about scheduling a medical exam and also want specific details of your family’s health history.

Key Article Takeaways

You may have heard of instant life insurance before. It is typically a term life insurance policy that does not require a medical exam, and the company will use underwriting data from sources like the MIB or Medical Information Bureau, a national prescription database, and sometimes your driving record.

Insurance companies today have embraced 21st-century technology that enables them to speed up the life insurance underwriting process and reduce their underwriting costs. This allows them to compete with fully underwritten life insurance rates (which includes the dreaded medical exam) and get the policies out the door quickly and efficiently.

Please don’t confuse instant-issue term life insurance with guaranteed-issue whole life insurance, which is typically purchased by seniors with multiple or severe medical issues. Instant life insurance is much cheaper than guaranteed-issue whole life insurance, and most companies offer coverage up to $1 million or higher.

However, there is an easier and faster way. There are highly-rated life insurance companies out there that will ask for minimal personal information to offer a quote and will never require a medical exam or the health history of your aunts and uncles.

Let’s drill down into instant life insurance to answer your questions and get your no-hassle shopping process underway!

How does Instant Life Insurance Work?

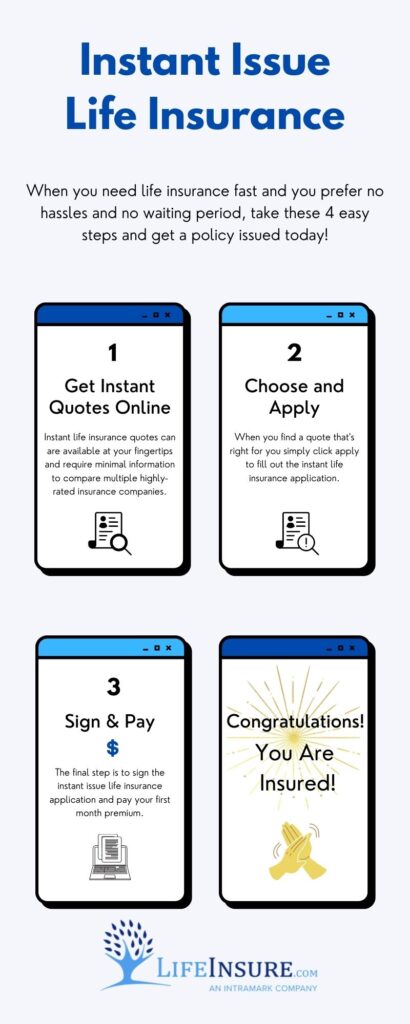

Instant life insurance allows a life insurance shopper to get multiple price comparisons and have their policy issued in four easy steps.

- Get an online quote with minimal personal information.

- Fill out the insurance application online.

- Sign the application online and pay the first month’s premium

Once you’ve completed this three-step process, your policy can be issued in a matter of hours rather than weeks and months, and your policy will be sent out immediately after it’s issued.

If you think the process is too fast for your liking, don’t worry about it because most companies offer a 30-day free look period. If, after reviewing your policy, you find that it’s not what you expected, you can simply cancel and return it for a refund.

What is Instant Life Insurance?

You may have heard of instant life insurance before. It is typically a term life insurance policy that does not require a medical exam, and the company will use underwriting data from sources like the MIB or Medical Information Bureau, a national prescription database, and sometimes your driving record.

Insurance companies today have embraced 21st-century technology that enables them to speed up the life insurance underwriting process and reduce their underwriting costs. This allows them to compete with fully underwritten life insurance rates (which includes the dreaded medical exam) and get the policies out the door quickly and efficiently.

Please don’t confuse instant-issue term life insurance with guaranteed-issue whole life insurance, which is typically purchased by seniors with multiple or severe medical issues. Instant life insurance is much cheaper than guaranteed-issue whole life insurance, and most companies offer coverage up to $1 million or higher.

How does Instant Life Insurance Work

Instant life insurance allows a life insurance shopper to get multiple price comparisons and have their policy issued in four easy steps.

- Get an online quote with minimal personal information.

- Fill out the insurance application online.

- Sign the application online and pay the first month’s premium

Once you’ve completed this three-step process, your policy can be issued in a matter of hours rather than weeks and months, and your policy will be sent out immediately after it’s issued.

If you think the process is too fast for your liking, don’t worry about it because most companies offer a 30-day free look period. If, after reviewing your policy, you find that it’s not what you expected, you can simply cancel and return it for a refund.

Instant Term Life Insurance vs Traditional Term Insurance

| Instant Term Life Insurance |

| Up to $2 million Death Benefit |

| No Medical Exam |

| 5, 10, 15, 20, 25, and 30-year Policy Terms |

| Online Underwriting |

| Medical Records not Required |

| No Waiting Period |

| Instant Approval and Issue |

| Premiums are slightly higher |

Traditional Term Life Insurance |

Up to $25 million Death Benefit |

Medical Exam Required |

5, 10, 15, 20, 25, and 30-year Policy Terms |

Full Underwriting |

Medical Records Required |

3 to 6 Week Waiting Period |

Typically Requires Agent Involvement |

Lower Premiums in Most Cases |

How do Instant Life Insurance Rates Compare with Traditional Term Insurance

Although instant-issue life insurance policies were typically much higher than traditional (fully underwritten), in today’s marketplace, the rates are only slightly higher than traditional term life insurance.

Because of technology that has been embraced by most insurance carriers, the underwriting process has become quicker and less costly because of the national databases that store the medical information and prescription history of many U.S. citizens.

However, please don’t misunderstand – this information doesn’t come from your physician records but rather from insurance companies who are members of these information providers. Moreover, when you fill out a life insurance application, there is a conspicuous area where you agree to let your insurance company share the medical information on the application.

Here are some actual rates for instant life insurance vs. traditional term life insurance:

Average instant issue rates for a healthy male non-smoker – average weight and height: 10-Year Term

Instant Life Insurance

| Age | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 25 | $10.42 | $14.96 | $22.25 |

| 35 | $11.67 | $18.08 | $26.42 |

| 45 | $16.75 | $30.58 | $41.83 |

| 55 | $28.75 | $58.92 | $81.00 |

Fully-Underwritten Term Life Insurance

| Age | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 25 | $8.13 | $11.62 | $17.27 |

| 35 | $8.39 | $11.83 | $17.93 |

| 45 | $12.74 | $21.78 | $35.11 |

| 55 | $23.99 | $45.26 | $80.11 |

Average instant issue rates for a healthy female non-smoker – average weight and height: 10-Year Term

Instant LIfe Insurance

| Age | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 25 | $7.50 | $8.29 | $10.17 |

| 35 | $8.75 | $10.58 | $13.50 |

| 45 | $10.58 | $22.46 | $30.58 |

| 55 | $21.58 | $41.63 | $56.00 |

Fully-Underwritten Term Life Insurance

| Age | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 25 | $7.04 | $8.92 | $11.44 |

| 35 | $7.20 | $9.13 | $12.19 |

| 45 | $10.16 | $15.49 | $24.65 |

| 55 | $17.40 | $30.35 | $49.71 |

Pros and Cons of Instant Life Insurance

As with any kind of life insurance, there are pros and cons depending on your personal circumstances and available budget.

Instant life insurance is for individuals who want to get a policy issued quickly and prefer not to have a medical exam. It is, however, a better fit for healthy individuals because insurance companies that offer instant life insurance generally go by acceptance or decline choices only.

Pros:

- Your policy can be issued the same day as applying

- No intrusive and inconvenient medical exam

- Rates that are only moderately higher than fully underwritten life insurance

- Deal directly with the company

- Choose your term length

Cons:

- Not a good choice for individuals who have below-average health or seniors

- Rates are higher than fully-underwritten life insurance

- Death benefit limits are generally $2 million or lower

- Many companies will not consider applicants with dangerous occupations or hobbies

Companies we Recommend for Instant Term Life Insurance Coverage

Although many insurance carriers offer no-exam life insurance, only a handful are really good at it and offer policies directly to consumers. Since these few companies are focused on instant-issue term life insurance, they may not offer traditional term, whole life, or universal life insurance. If not, the instant life insurance you purchase will likely not have a conversion option.

Policy Periods | 10, 15, 20, 25, and 30-year terms |

Coverage Amounts | $20,000 to $1,500,000 |

Eligible Ages | 18 to 60-years-old |

Medical Exam | NO |

Life Insurance Products | Term Life Insurance |

Policy Periods | 10, 15, 20, and 30-year terms |

Coverage Amounts | $20,000 to $2,000,000 |

Eligible Ages | 20 to 65 |

Medical Exam | NO |

Life Insurance Products | Term Life and Guaranteed Issue Whole Life |

Policy Periods | 10, 15, 20, and 30-year terms |

Coverage Amounts | $50,000 to $2,000,000 |

Eligible Ages | 20 to 60 |

Medical Exam | NO |

Life Insurance Products | Term Life and Universal Life |

For more information about instant life insurance or any other types of life insurance, call the insurance pros at LifeInsure.com at (866) 868-0099 or contact us through our website 24/7.

Instant Life Insurance FAQs

Instant life insurance refers to life insurance policies that can be applied for and issued quickly, often without the need for a medical exam. This allows individuals to get coverage almost immediately, making it a convenient option for those seeking life insurance online.

You can buy instant life insurance online by visiting life insurance companies’ websites that offer online applications. Look for options that allow you to apply for life insurance without a medical exam, and follow the prompts to complete your online application.

There are several types of instant life insurance, including guaranteed issue life insurance and simplified issue life insurance. Both options typically don’t require a medical exam and are designed for those who need life insurance quickly.

To qualify for instant life insurance, you typically need to meet certain criteria set by the insurer, such as age and health status. Some policies may require you to answer questions about your health but may not require a medical exam.

It depends on the type of instant life insurance you apply for. Guaranteed issue life insurance may be available regardless of health issues, while simplified issue life insurance may require you to answer questions about your health to help the insurer assess your risk.

The coverage amount for instant life insurance varies by provider and policy type. Typically, instant policies may offer lower coverage amounts compared to traditional life insurance options, so it’s important to review your insurance needs and get a quote from multiple life insurance companies.

The time to get instant life insurance can be very quick, often within a few minutes to a couple of days, depending on the insurer’s processes. Many life insurance companies allow you to get an instant policy after completing the online application.

When applying for instant life insurance, you will typically need to provide basic personal information such as your name, age, social security number, and possibly some health-related questions, depending on the type of policy you choose.

Last Updated on September 23, 2024 by Sonny O'Steen