Actually, Final Expense Insurance is not a type of insurance product but a “purpose” for life insurance. What we mean by this is that when you buy final expense insurance, your policy is unlikely to have the term “Final Expense Life Insurance” anywhere on the contract.

You see, insurance is a method of mitigating financial risks in your everyday life, and the type of insurance used is always going to be some form of the following:

[su_list icon=”icon: arrow-circle-right”]Although you can purchase a final expense policy using Term Life Insurance, in the majority of cases, Whole Life insurance will always be the type of policy used for Final Expense Insurance. The primary reason for using whole life is that the policy can last a lifetime, while term insurance usually provides temporary coverage.

Also, when you buy final expense insurance on a whole life policy, you will get the same guarantees and benefits of a traditional whole life insurance policy. These guarantees are important in order for your policy to provide lifetime coverage and build cash value.

This is what makes Whole Life Insurance the better policy for final expense insurance:

Final Expense Insurance is a whole life insurance policy that is designed to pay for your final expenses when you die. Unless these expenses are taken care of with other life insurance or money from your estate, these costs are typically passed on to surviving loved ones.

Certainly, the last things you want to leave when you pass away are the costs of a funeral and other services to your grieving family members, when you can easily pre-fund all of these expenses by purchasing affordable final expense insurance.

For most seniors, the most significant final expenses that must be dealt with when they die are their funeral and burial service. Even if the policyholder prefers to be cremated, there are still significant expenses if you choose to have a memorial service along with the cremation.

Although funeral costs vary depending on the type of funeral and the state you live in, we can estimate very closely what you should expect to insure for. When we determine the average cost of a funeral and burial, it makes sense to go to the source, The National Funeral Directors Association. Here is what they reported for 2018:

National Median Cost of an Adult Funeral with Viewing and Burial 2017

| Basic Service Fees | $2,100 |

| Transport of remains to funeral home | $325 |

| Embalming | $725 |

| Other preparation of the body | $250 |

| Use of facility and staff for viewing | $425 |

| Use of facility and staff for the funeral ceremony | $500 |

| Hearse and service car/van | $475 |

| Basic memorial print package | $150 |

| Metal casket | $2,400 |

| Vault | $1,395 |

| Cemetery plot | $1,000 |

| Total Costs for Funeral and Burial | $9,755 |

It’s important that we remind you that this chart is for the national median cost (average) of a funeral and burial. Funerals can become significantly more expensive when you start adding the bells and whistles that most funeral directors will always bring up. You can, however, pay much less than what’s listed here if you shop a funeral in advance, shop the casket, and get your church to offer their facilities.

Cremation is certainly an alternative that can reduce the cost of a traditional funeral, but even cremation can be expensive when you add a memorial service or decide to bury the ashes.

National Median Cost of an Adult Funeral with Viewing and Cremation 2017

| Basic Service Fees | $2,100 |

| Transport of remains to funeral home | $325 |

| Embalming | $725 |

| Other preparation of the body | $250 |

| Use of facility and staff for viewing | $425 |

| Use of facility and staff for the funeral ceremony | $500 |

| Service car/van | $150 |

| Basic memorial print package | $150 |

| Cremation Fee and Urn | $350 |

| Cremation Casket | $1,000 |

| Total Costs for Funeral and Cremation | $6,260 |

Although a funeral and cremation service is less than a traditional funeral, there are still areas where you can save money on the products and services offered by the typical funeral home.[/su_note]

It depends. If you are looking for the lowest rate for a traditional final expense policy that offers a level death benefit and first-day coverage, you won’t have to have a medical exam, but you will have to answer a lot of questions about your health on the application.

Most companies will offer coverage even when you have some health issues, but there are some questions that are considered “knockout” questions, and if you answer yes, you will likely be declined.

The health questions that will likely lead to a decline if you answer “Yes” are:

Chest pains (Angina) in the last 12 months

Currently in the hospital, a nursing home, or hospice care or facility

Tested positive for HIV or AIDS

Currently on Dialysis

Diagnosed with any kind of Terminal Illness

Stroke in the last 12 months (excluding mini-stroke)

Alzheimer’s or dementia

Currently under treatment for Cancer

Wheelchair-bound as a result of a chronic illness

Had or on a waiting list for organ transplant (corneal excluded)

Even though final expense insurers do not order medical exams or blood and urine tests, they can still find some medical information about you in other places besides the insurance application. Some of the sources are:

Medical Information Bureau (MIB) – The Medical Information Bureau is an organization owned by member insurance companies that compile data about your health. The bulk of the information that is compiled is the information you supply on your insurance application. This is not a mammoth database that has every person’s medical history. It is a repository for insurance companies to verify the information you’ve already supplied elsewhere, and you give the company permission to view this data when you sign your life insurance application.

RX Check – There are several companies that store information on all the prescription drugs you take, and the information comes from pharmacies across America. While this data doesn’t include why you were prescribed a medication, the insurance underwriters can surmise why you may be taking it.

As we mentioned earlier, there is an alternative insurance product that is available that does not take your health into consideration when they underwrite your insurance policy. These policies have become very popular with the senior crowd who are dealing with multiple health issues that prevent them from getting approval for traditional final expense insurance.

A graded benefit plan typically contains a two or three-year waiting period before the insurance company will pay the full death benefit if a policyholder dies because of natural causes.

Typically, these policies will pay a percentage of the full death benefit if you die of natural causes in the first year of about 25 to 40% of the death benefit. If you die because of natural causes during the second year of the waiting period, the company will then pay about 70 to 80% of the death benefit. Then, starting in year three, the company would pay the full death benefit.

It’s important to note that most insurers will pay the full death benefit from the first day if the death is the result of an accident.

The Guaranteed Issue final expense plan is similar to the graded benefit plan except for how the death benefit is paid out. Typically, if a policyholder dies within the two or three-year waiting period from natural causes, the insurer would pay your beneficiary 110% of the premiums you’ve paid to the company.

For example, let’s imagine that you have a Guaranteed Issue final expense policy with a $15,000 death benefit, and you’re paying $80 per month. If you were to die 18 months after your policy was issued, your beneficiary would receive $1,584 ($80 x 18 plus 10%) instead of the full death benefit of $15,000.

Once your waiting period is exhausted, your beneficiary will receive the full death benefit no matter the cause of your death. Also, death resulting from an accident would not be subject to the waiting period. In other words, the full death benefit begins from the first day of coverage for accidental death.

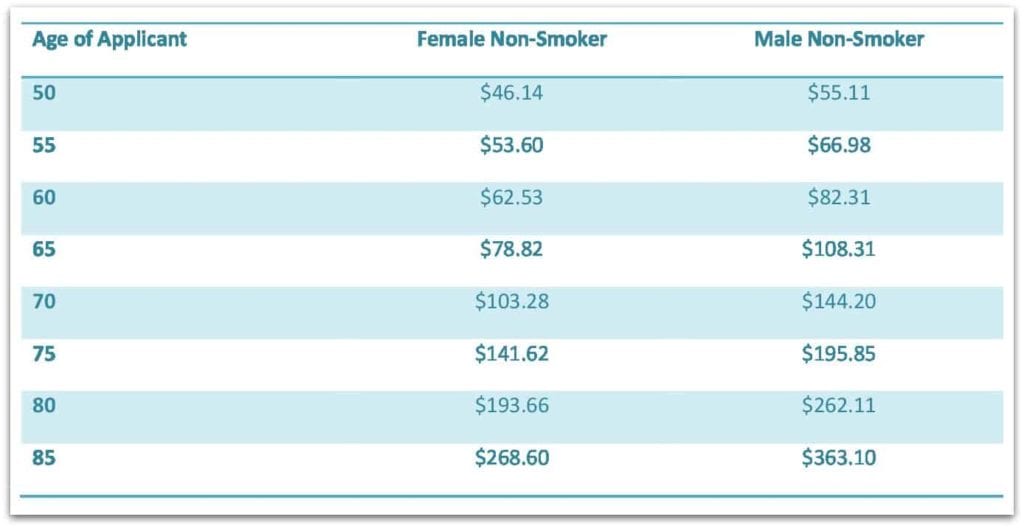

Like any other type of life insurance, the insurance rates are based on your age and your health. If you were to apply for and be approved for a $20,000 Final Expense plan, here’s what you can expect to pay:

As you will notice, the life insurance rates for men are more than the rates for women. This is because women typically live longer than men, and therefore, the insurance company will have a long period to collect premiums. Please note that these rates are for non-smokers. Smoker rates are significantly higher.

As we mentioned earlier, a guaranteed issue policy does not take your health history into consideration when the policy is underwritten. There are a few knockout questions on the application, but most applicants are able to get the coverage they need.

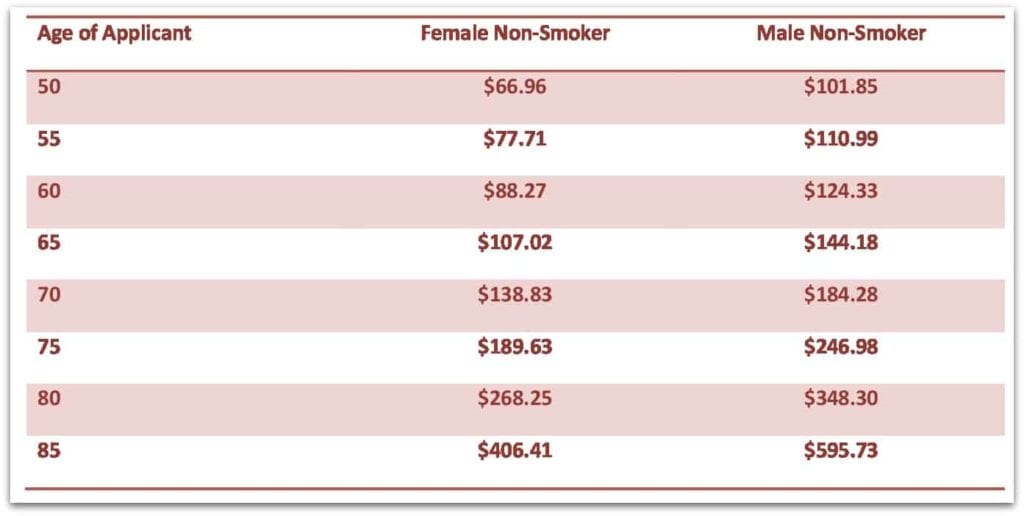

Here are the actual rates for a $20,000 Guaranteed Issue Final Expense Policy:

As you will plainly see, the rates for Guaranteed Issue Final Expense Insurance are much higher than the rates for Level Benefit Final Expense Insurance. This is because the insurer is accepting an unknown health risk.

It’s important that you shop your final expense insurance with an independent broker who represents the top-rated carriers that offer Level Benefit Final Expense insurance and Guaranteed Issue Final Expense Insurance.

This means you should stay away from buying directly through a company or doing business with a “captured agent” who only represents one company.

When you use an independent broker like LifeInsure.com, you have the ability to shop your policy with all the top-rated carriers and get advice from an insurance professional who is experienced and reputable. At LifeInsure.com, we will shop your application with all our carriers and then deliver the best solution that will meet your needs and your budget.

[su_box title=”Speak with a Professional” style=”glass” box_color=”#1a83c9″ title_color=”#ffffff”]For more information about final expense insurance, call the professionals at LifeInsure.com. You can reach LifeInsure.com at (866) 868-0099 during normal business hours.[/su_box]LifeInsure.com® is a registered

trademark of Intramark Insurance,

Services, Inc. © 2025.

Privacy Policy

Terms & Conditions

Legal Notice & Disclaimer

Here is the legal information we’re required to provide you. LifeInsure.com, a California corporation and subsidiary of Intramark Insurance, is a licensed independent insurance broker. The information provided on this site has been developed by LifeInsure.com for general informational and educational purposes. We try hard to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application.