CALL US NOW!

Putting a solid estate plan in place is an important part of making sure that your loved ones won’t find themselves facing unnecessary financial hardship if something happens to them. The process of estate planning can vary greatly, depending on individuals’ net worth, business holdings, and a variety of other factors.

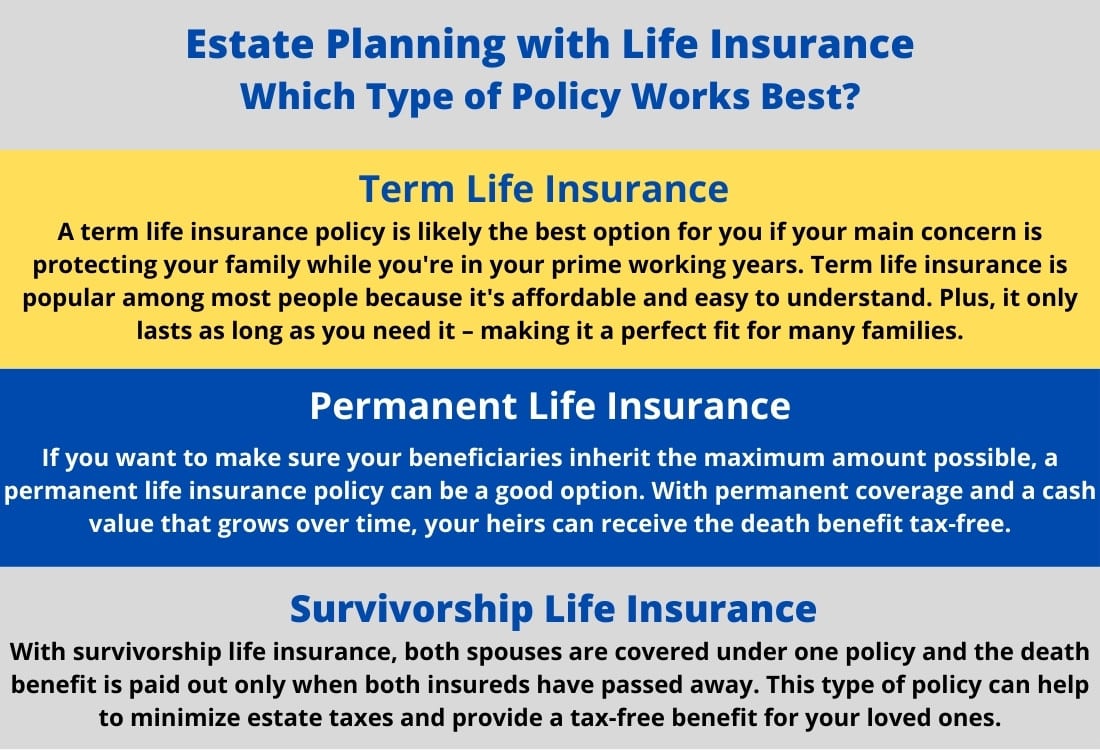

Life insurance is an integral component of any comprehensive estate plan, no matter what other factors need to be taken into consideration.

Easy Article Navigation

- Life Insurance in Estate Planning

- The Irrevocable Life Insurance Trust (ILIT)

- An ILIT We Trust

- Two Major Snafus to Avoid

- Shield Your Estate Plan

- Take Action Now!

- Frequently Asked Questions

Even if your net worth is sizeable, your loved ones might not be able to access the assets quickly enough to take care of immediate financial needs. That’s why proper planning using life insurance can be so beneficial.

If your estate plan doesn’t include life insurance, your family could face the difficult situation of not being able to manage the expenses of daily living, let alone cover the costs of your funeral.

When planning with life insurance benefits, your loved ones won’t have to worry about how they’ll find the money to make ends meet in the event you are no longer around.

Proceeds from life insurance are paid directly to the named beneficiaries so that individuals (or those individuals) won’t have to wait out potentially lengthy and complicated probate proceedings to access the funds.

Life Insurance in Estate Planning

Estate planning is not just about protecting your assets – it is also about providing for your loved ones in the event of your death. Adding life insurance to your estate plan can help give your heirs the financial flexibility they may need in the future.

For many families, life insurance is a way to replace lost income in the event a parent or spouse dies unexpectedly.

If you are looking to add value to your estate, taking out a large life insurance policy can be a good option. However, it is important to keep in mind that the proceeds from the policy will be subject to federal estate taxes. One way to avoid this is to name an irrevocable trust as the beneficiary of the policy.

Your heirs will have access to immediate liquidity to cover any outstanding estate fees or necessary expenses. This provides peace of mind and ensures that your loved ones are taken care of after you’re gone.

The Irrevocable Life Insurance Trust (ILIT)

There are numerous ways to use life insurance to help pay for estate planning, but the use of an Irrevocable Life Insurance Trust (ILIT) is a place to start.

This article reviews what an Irrevocable Life Insurance Trust is, what it does, and when one should use one. This obviously isn’t the only strategy for use in life insurance for estate planning, but is a basic one.

This article was partially written for LifeInsure.com by an attorney, and when you inquire with us about utilizing life insurance for estate planning and for payment of estate taxes, we will be working with your attorney or can recommend one to you. LifeInsure.com does not give legal advice, but we certainly are familiar with working attorneys for estate planning.

In An ILIT We Trust (Irrevocable Life Insurance Trust)

Proceeds from life insurance policies have saved many families from financial ruin. Even if you have a good bit of money saved to pass along to your heirs, account access can be tied up in probate for months.

Funeral expenses, mortgage payments, car notes, and other expenses won’t go on hold while your estate is being probated. If you want to make sure that your loved ones won’t have to struggle with coming up with the means to pay these expenses, it’s essential to make sure that your estate planning efforts include a sufficient amount of life insurance.

Life insurance can help you provide for your loved ones’ financial security after your death. However, careful planning is necessary in order to avoid decisions that could threaten the estate-tax-free status of your life insurance proceeds and significantly reduce the amount that’s left for your family – or that could prevent them from receiving the proceeds according to your wishes.

Let’s examine two major snafus you can avoid when you employ an irrevocable life insurance trust (ILIT).

1. If You own the Policy

It’s not uncommon to purchase life insurance to cover estate taxes. But the policy proceeds intended to pay the estate tax bill can end up increasing the bill if you’re not careful. Why? Because even though the proceeds are income-tax-free for the beneficiaries, the money may be included in your estate and, thus, be subject to estate tax.

One way to prevent this outcome is by creating and setting up an ILIT to own the policy. After your attorney sets up the trust and you name the trustee (such as a friend, family member, lawyer, accountant, or bank) and beneficiaries, you can begin making cash deposits into the trust, in essence, paying the policy’s premiums.

Your cash contributions to the trust to cover premium payments are considered taxable gifts, so a gift tax return may be required. With savvy planning, however, you can minimize or even eliminate gift taxes by using annual gift tax exclusion amounts.

Keep in mind that, for the ILIT to be successful, you can’t retain any incidents of ownership in the policy. This includes the right to borrow against the policy’s cash value or retain the right to change beneficiaries.

Also, try to avoid transferring an existing policy to an ILIT. If you die less than three years after the transfer, the three-year rule will kick in and draw the proceeds back into your estate. By having the Irrevocable Life Insurance Trust buy a new policy on your life, you can avoid this outcome. Bear in mind that if your primary goal is to be able to withdraw funds from the policy during your retirement years, an ILIT probably isn’t the right vehicle for you.

2. If A policy Beneficiary is a Minor or is Legally Incompetent

You naturally want to ensure that your children will not be harmed financially and will be able to retain business interests and other assets after your death (or the death of you and your spouse).

But, one of the biggest and most common snafus you can make is designating a minor or legally incompetent person as a beneficiary of your life insurance policy. Doing so defeats the purpose of providing for your loved ones after you’re gone because insurance companies generally won’t pay large sums of money directly to a minor or an incompetent person.

The result? Your executor will have to go through the lengthy and expensive process of arranging a court-appointed guardian before the death benefits are released to your family members.

And if the appointed guardian doesn’t have your loved one’s best interest at heart, your plans could go up in smoke. What’s more, in the case of a minor, the beneficiary will gain unrestricted access to the funds as soon as he or she reaches the age of majority, regardless of his or her ability to manage the assets.

Designating an ILIT as the beneficiary of the insurance policy can help prevent this outcome. An Irrevocable Life Insurance Trust provides you with the flexibility to establish detailed criteria for how and when the proceeds will be distributed to or on behalf of your loved ones.

You can instruct the trustee to distribute the funds to beneficiaries at any age you wish, even into adulthood. For example, you can allocate distributions for college tuition or health care or make them contingent on certain achievements, such as graduating from college, becoming active in the family business, or being gainfully employed elsewhere.

You can use distributions to reward exemplary behavior, such as becoming involved in a charity or celebrating certain milestones, such as a birthday or wedding.

For a beneficiary who is severely disabled or otherwise legally incompetent, consider establishing a Special Needs Trust that provides for his or her comfort and cost of living without jeopardizing eligibility for government assistance.

Shielding Your Estate Plan

A life insurance policy can help protect your family’s financial future. An ILIT can help ensure the policy works as you intend by shielding your estate plan from snafus that make policy proceeds vulnerable to hefty estate taxes or prevent the proceeds from being distributed according to your wishes.

The Private Client Group at LifeInsure.com can help you determine whether an ILIT is right for your situation and, in coordination with your attorneys, can recommend a beneficial plan to establish the liquidity necessary to pass on assets with minimal estate tax obligations.

Take Action Now!

While most people recognize the importance of proper planning, it’s very common for individuals to put off making estate planning decisions until they think they’re old enough to need to make provisions for the future.

Before you decide that it’s not time to worry about retirement and creating an estate plan just yet, stop and think about these three reasons that it’s important to start the estate planning process today:

- Life is unpredictable. None of us knows what tomorrow, or even the rest of today, might bring. Putting off estate planning until the future places your loved ones at risk.

- Legal documents can be executed only by individuals of sound mind and body. No one plans to become impaired, but it does happen. If it happens to you, there’s a very real chance that you can lose the ability to make decisions regarding your estate.

- The younger you are when you purchase life insurance, the less expensive your life insurance premiums will be. If you develop a serious illness before obtaining life insurance, you may not even be able to get coverage at all.

For an initial no-obligation discussion, contact us or call us at 866-868-0099 the information contained in this article was provided by The Law Offices of Afshin A. Asher, with offices in Los Angeles, California.)

Frequenstly Asked Questions

An estate plan is a comprehensive strategy that outlines how your assets will be managed and distributed after your death.

Estate planning is crucial to ensure that your assets are passed on according to your wishes, minimize estate taxes, and provide for your loved ones.

Estate tax is a tax imposed on the transfer of a person’s estate after their death. It is calculated based on the total value of the estate.

A beneficiary is an individual or entity designated to receive assets from a life insurance trust or as part of an estate plan.

An irrevocable life insurance trust is a trust that cannot be modified once established and is commonly used to hold a life insurance policy.

Life insurance can play a significant role in estate planning by providing liquidity to pay estate taxes, equalize inheritances, and ensure financial security for heirs.

The death benefit of a life insurance policy is the amount paid to the beneficiaries upon the death of the insured.

A trustee is a person or entity responsible for managing the assets held in a trust and distributing them according to the terms of the trust document.

CALL US NOW!

Last Updated on October 21, 2024 by Richard Reich