Check Term Insurance Rates Now!

Life insurance is most commonly used to ensure one’s family is protected financially in the event of the death of the primary breadwinner. However, there are many ways business life insurance can be used to protect the business. This type of planning is referred to as “business continuation,” and every small or medium-sized business should employ a specific strategy to contend with business interruption, a risk that every business is susceptible to. Here we will discuss the two most popular business continuation practices and how they can be implemented at a very low-cost using term or permanent life insurance.

Term or Permanent Insurance?

In some business insurance situations, a permanent policy (whole or universal life) can provide some benefits that term life insurance cannot. First of all, a whole or universal life policy will provide cost recovery at some time, either upon the death of the insured or, in some cases, by accessing the cash value of the policy. Additionally, if the business is the owner of the policy, the cash value will show up on the books as an asset.

Another benefit of permanent insurance is that a properly funded permanent policy can be used as a retirement supplement for the owner or the key employee (as a distribution if the employee leaves or retires). Businesses often offer this benefit as an incentive (golden handcuff), a great method of retaining employees. We advise that you check with your accountant to properly structure this type of arrangement.

If the premiums for a permanent policy don’t fit into the business budget, the return of premium term life insurance is another solution we recommend for business insurance. With this type of policy, the business would pay a level premium, and at the end of the term, the business would receive all the premiums back.

The premiums for these policies are more expensive than regular term policies, but there will be a full cost recovery if the insured person outlives the policy. Or, as with the cash value of a permanent policy, the premium refund can be used as a golden handcuff, providing the key employee with an incentive to stay employed.

Key Person Insurance

Almost every small or mid-size business normally has a key person or persons that are responsible for delivering a large portion of the company’s revenue. Service-type businesses are typically reliant on a key person who continuously delivers earnings from their coveted client list. If the business were to lose one or more key persons due to an unexpected death, that business is very likely to experience serious financial challenges until a qualified successor can be recruited and trained.

According to Entrepreneur.com, Key Person Insurance is defined as:

“Life insurance on a key employee, partner or proprietor on whom the continued successful operation of a business depends. The business is the beneficiary under the policy.”

Service Businesses are Especially Vulnerable

The manner in which most service businesses operate makes them perfect candidates for key-person insurance. Most service businesses rely on a small number of key individuals to bring in a majority of the revenue that supports the business operation. These key people might be executives or partners in the company or team members who have proven to be considered valuable to ensure company operations continue quarter after quarter and year after year.

But it’s not always about revenue. Many key individuals are not considered expendable because of their client list, significant industry experience, or understanding of the services being offered by their business. Many team members in a small business organization may be considered invaluable because of their marketing results or technology skills.

The business leaders need only to run reports that identify new and recurring revenue and marketing successes to quickly discover who the top performers are in the organization.

How Key Person Insurance Works

The business principal(s) designates who in the company is thought to be a key person and then purchases a life insurance policy on that person. The company is the owner of the policy, pays the periodic premiums, and is the beneficiary of the policy. If the insured key person dies unexpectedly, the business would receive the death benefit from the insurance company tax-free.

The business owner(s) would then have the required funds to pay the expenses resulting from the death of the key person:

[su_list icon=”icon: check” icon_color=”#1881CA”]- Recruiting costs for a replacement

- Pay off debts to eliminate or reduce operating costs while a replacement search is underway.

- Distribute all or a portion of the money to investors in the business

- Pay severance packages if the decision is to cease operations

- Use the funds to purchase shares back from survivors to regain ownership

Which Type of Insurance is Less Costly?

Certainly, Term Life Insurance is the most budget-friendly insurance product to fund a key person insurance plan. Since term insurance provides temporary coverage for up to thirty years and has a very low mortality rate, the insurance has much lower rates than permanent insurance like universal life or whole life insurance. There are additional key benefits that make term insurance the perfect solution for the loss of a key person.

According to InstantQuoteLifeInsurance.com, a business leader can make use of other key benefits found in a term insurance key person policy:

[su_list icon=”icon: check-square” icon_color=”#1881CA”]- Most life insurers offer policy terms for up to thirty years.

- Many insurers offer a “return of premium” rider that would provide for the insurer to return all premiums paid to the business if the key person outlives the policy term. The business owner could use some or all of the returned premium as a retirement gift for the loyal key person or as a signing bonus for the retiree’s replacement. The money belongs to the business and can be used in any way needed.

- Most insurers offer an accelerated death benefit rider that allows the insured to receive a large percentage of the death benefit if diagnosed with a terminal illness.

Business Continuation Using a Buy-Sell Agreement

For businesses that are set up as partnerships or Limited Liability Companies with multiple members who control shares of the business, the death of one or more of the stakeholders will automatically create problems for the surviving owners as the decedents’ shares are passed to heirs.

For example, ABC Realty Group is a partnership organization with three partners owning the same value of shares. If one partner dies unexpectedly, his or her shares in the business would pass on to surviving family members. Certainly, the surviving partners will want to purchase those shares and return them to the partnership, but the partners may not be prepared to offer the value of the shares to the recipient.

In this case, the business needs a Buy-Sell Agreement (also referred to as a buyout agreement) to protect the owners or partners of a business if one or more of them should die unexpectedly. The Buy-Sell agreement, which is normally drawn up by an attorney or CPA, provides specific instructions for the surviving business owners if one of the owners should die. These instructions typically include the following:

[su_list icon=”icon: forward” icon_color=”#1881CA”]- Buy back the shares of the business from the heirs or estate of a principal.

- Determining a precise value for the company for estate and tax purposes

- Limit transferability during life and at the death of ownership control and interest.

- Affirm and determine which events can activate the right or responsibility to buy or sell

- Make it feasible for employees to buy the company from the estate or family members of a principal.

Funding the Buy-Sell Agreement

The most affordable solution for funding a Buy-Sell agreement would be to use Term Life insurance, and there are two popular methods that are generally employed:

Entity Purchase Arrangement

This is a succession strategy designed for businesses with more than one owner. The plan is developed by having the business acquire an insurance policy on the lives of every owner in an amount comparable to each owner’s interest in the organization. The company owns and pays the premium for the insurance policies and is the named beneficiary of each insurance policy. Should an owner die, the benefit received by the organization from the insurance policy is utilized to buy out the departed owner’s portion of the business from the named insured’s estate.

Business owners usually risk a considerable amount of finances and invest a substantial amount of time to get their business up and operating, but some fail to undertake a strategy for continuation when the worst situation happens unexpectedly. Guaranteeing the continuity of your company is as crucial to employees as it is for family members. Simply take the time to understand Buy-Sell Agreements and how they can simply be funded using inexpensive term life insurance.

Cross-Purchase Plan

When utilizing a cross-purchase type of arrangement, each partner or principal is expected to purchase and own life insurance for the other partners or principals. The partner or principal would then pay the policy premium and become the beneficiary on each policy purchased by the other partners or principals.

The death benefit on the insurance policies would match the interest each partner or principal has in the business. When a partner or principal dies, the surviving principals will utilize the death benefit to acquire the shares of the deceased partner or principal from his or her remaining family members or the estate.

The Cross-Purchase strategy will likely prove to be very cumbersome if there are more than a few partners or principals. Therefore, the company ownership could choose to utilize a “trusteed” cross-purchase agreement.

Using a “trusteed” cross-purchase strategy enables the company principals to employ a third-party organization or person to act as trustee or escrow agent to satisfy the mutual responsibilities to each other that are developed in the cross-purchase agreement.

Which Type of Insurance Works Best?

Once again, in the case of Buy-Sell agreements, term life insurance can be the most affordable funding solution for your business continuation plan. Term policies can be issued with up to 30-year terms and can also be purchased with various riders that serve to broaden the coverage in the policy. Fortunately for business owners, term insurance has become very competitive, and policies can be issued with very high death benefits but with very affordable rates.

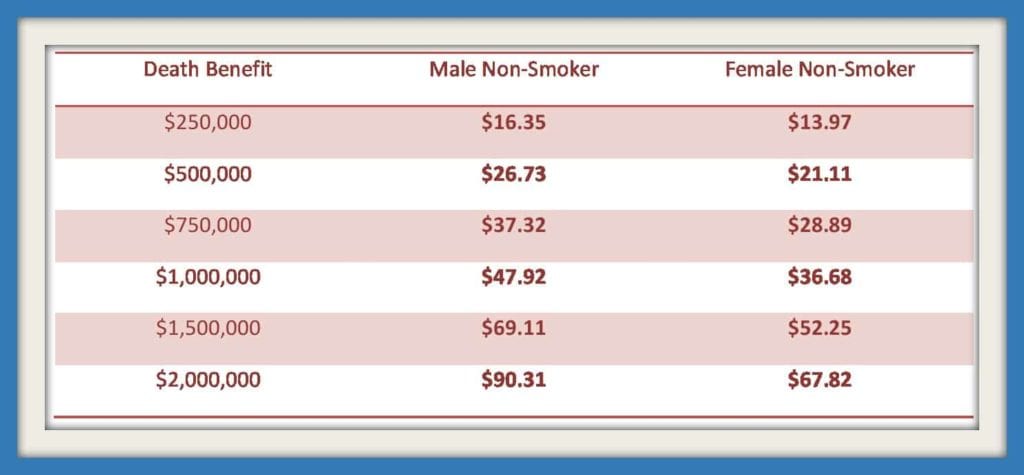

Listed below are actual term insurance rates showing the monthly premium for various amounts of insurance for a 30-year-old male and female non-smoker with a 20-year policy:

These rates are for a 30-year-old non-smoker preferred rating. All quotes provided by the LifeInsure quote engine are subject to medical underwriting and the company’s height and weight chart. For an accurate quote for your actual age, please use our quote form on the right of this page and then verify your quote after speaking to one of our insurance professionals.

What about Tax Considerations?

While tax concerns should be addressed by your CPA, there are some basic considerations that can be addressed here:

[su_list icon=”icon: bank” icon_color=”#1881CA”]- All insurance premiums used to finance a buy-sell agreement are not tax-deductible.

- The death benefit is delivered tax-free irrespective of who acquired and owns the insurance policy unless the death benefit is payable to certain corporations. The death benefit that is received by the C corp may result in an alternative minimum tax for the corporation. For the death benefit to be received tax-free, there can be no exchange for valuable consideration.

- Insurance premiums paid by a company in which the shareholder is the named insured are not regarded as taxable income to the insured person.

- There is no gift tax responsibility upon the execution of a buy-sell agreement.

- When implementing a cross-purchase agreement, one should be cautious of the transfer for value rule.

Where to Purchase Term Insurance for Business Continuation?

Once you have spoken with an attorney or CPA, your best strategy to get the most affordable term insurance rates from a highly-rated insurance carrier is to speak with an insurance professional at LifeInsure.com. LifeInsure represents all of the top-rated national insurance carriers and will submit your request to every carrier to find the best solution for your insurance needs.

We understand that price is important, but we also want to make sure the carrier we select is highly rated and has an affinity for offering term policies that best meet your needs. If you prefer, you can call us before speaking with your attorney or CPA to get some information that they will likely need from you. LifeInsure insurance professionals are no strangers to designing insurance coverage for business continuation plans.

[su_box title=”Speak with a Professional” style=”glass” box_color=”#1a83c9″ title_color=”#ffffff”]For more information about Key Person insurance or funding for Buy-Sell Agreements, call an insurance professional at LifeInsure.com (866) 868-0099 during normal business hours or contact us through our website.[/su_box]Check Term Insurance Rates Now!

Last Updated on November 23, 2024 by Richard Reich