No Exam Life Insurance Quotes

Ask a hundred people if they want cheap life insurance and everyone raises their hand. Then ask that same hundred people if they’re ready to take a life insurance exam; crickets. Let’s talk about best no exam life insurance.

Most insurance professionals agree that to get the lowest insurance rates possible, the applicant needs to undergo a life insurance medical exam.

Easy Article Navigation

While that’s true in many cases, it’s not true in all cases. Here’s the reason why.

Unless you need to purchase more than a million dollars of life insurance, there are companies out there who sell no exam life insurance at rates that are very competitive with fully-underwritten (you take the exam) life insurance.

Companies We Recommend

Banner Life

| Company Description | Banner Life is a subsidiary company of Legal & General which is in the top 10 largest insurance companies worldwide. Banner continues to enjoy its A+ (Superior) rating from A.M. Best. |

| Policy Types - Approval Times | Banner offers simplified term life insurance with policy terms of 10, 15, 20, 25, 30, 35, and 40-years. |

| Eligibility & Coverage Limits | Eligible Ages and Coverage Limits: 20 to 60 $100,000 to $2 million |

| Best Suited For: | Banner Life is best suited for applicants in average health or better. Applicants in are in good health and under will typically find Banner is the best option for no exam life insurance. |

Lincoln National Life

.

| Company Description | Founded in the early 1900s, Lincoln Financial is an A+ (Superior) rated company that is ranked in the Fortune 250 list of companies. |

| Policy Types - Approval Times | Lincoln is one of the few companies that offer no exam term life insurance with instant approval times. |

| Eligibility & Coverage Limits | An eligible applicant for no exam term must be 18 - 60 and coverage limits are $100k - $2.5 million |

| Best Suited For: | Lincoln is a great solution for applicants who are in very good health and need a lot of coverage. They will also accept tobacco users who do not smoke cigarettes. |

Pacific Life

| Company Description | With over 150 years of experience, Pacific Life is a mutual life insurance company with over 898,000 members. The company has $191 billion in assets and is rated A+ by A.M. Best |

| Policy Types – Approval Times | Pacific is one of many companies that offer no exam term life insurance with approval times within two weeks of completing a telephone interview. |

| Eligibility & Coverage Limits | Eligible applicants for no exam term must be ages 18 – 60. Coverage limits are $2 million. |

| Best Suited For: | Pacific Life is an excellent choice for applicants preferring a well-known and well-established insurer and benefit limits of up to $2 million. |

SBLI

| Company Description | SBLI is known for its founder, Louis Brandeis, who established the company in 1907 and later became Chief Justice of the United States Supreme Court. The company enjoys its rating of A (Excellent) from A.M. Best and A+ from the Better Business Bureau. |

| Policy Types - Approval Times | SBLI uses Accelerated Underwriting to deliver super competitive rates and approvals within 2 weeks of application. |

| Eligibility & Coverage Limits | Eligible applicant ages are 18 to 60-years-old with coverage amounts of $100k - $750k |

| Best Suited For: | SBLI is a go-to insurance carrier for agents and applicants because of its liberal underwriting and level term policies for up to 30-years. |

Symetra Life Insurance

| Company Description | Symetra is a family of financial services companies that offer life insurance, annuities, retirement, and employee benefits products. |

| Policy Types - Approval Times | Symetra offers its SwiftTerm product for individuals who prefer affordable rates for policies that can be issued in as little as 25 minutes. |

| Eligibility & Coverage Limits | Eligible applicant ages are 18 to 60-years old with coverage limits of $100k - $2 million. |

| Best Suited For: | Young and healthy men and women who are non-smokers and are searching for a policy as soon as possible |

No Exam Life Insurance Quotes

When an insurance company requires a medical exam, they will also likely ask for attending physician statements from any doctor who has treated you for an illness in the last 3 to 5 years. Between the medical exam and physician record requests, approvals generally take a few months rather than weeks or even days

5 Easy Steps to Apply for Your Best No Medical Exam Life Insurance Policy

Compare Quotes and Submit the Application

When you fill out and submit a quote on the LifeInsure.com website, you will be presented with a list of companies we represent who are willing to offer the life insurance policy you have selected based on the profile information you provided. We recommend that you complete the non-sensitive policy information and then submit your request to us on our website. One of our insurance professionals will contact you shortly afterward to help complete the application and answer any questions you may have about coverage or rates.

Confirm and Sign

After completing the insurance application, our office will send the necessary application documents to you electronically for you to review and sign. We’ll then become your advocate in the application and underwriting process and assist if there are any “bumps-in-the-road” during the underwriting process.

Get a Quote from an Independent Agent Like LifeInsure.com

An independent life insurance agency like LifeInsure.com will have access to all the major highly-rated insurance companies. This allows your independent agent to shop your quote with multiple carriers simultaneously. It’s a quick and easy process and is at no cost to you.

Receive and Review Your Life Insurance Policy

Once your application has been approved by the underwriter, the company will offer you a policy contract for your review and signature.

Sign and Send Your Initial Payment

If you are satisfied after reviewing the policy contract, you will electronically sign the contract and submit your initial payment for binding coverage.

Please note: You will have 30 days to review the contract and once you receive the policy, you’ll have a 30-day free look period to decide to keep the policy or return it for a full refund of your initial premium.

Who Typically Chooses No Medical Exam Life Insurance?

People who choose no exam life insurance generally do so for a variety of reasons:

- The convenience of not having an unknown person in their home or workplace

- Consider a life insurance exam as an invasion of privacy

- Prefer not to have a stranger touching them or asking questions about their health

- Prefer to have an insurance policy issued quickly (for a variety of reasons)

- Are aware that no exam policies are priced almost the same as fully-underwritten policies

- The ability to complete the entire insurance purchase transaction online

There are also many people who may not want certain health conditions disclosed and feel that not having no exam life insurance will help them keep those conditions private and “off the record.” (we disagree with this reasoning, as we always recommend full disclosure with insurance underwriters).

Types of No Medical Exam Life Insurance Policies

When we discuss no medical exam life insurance, we are talking about the underwriting process and not the type of life insurance.

With access to 21st Century technology, many life insurance companies are embracing innovative technology that allows the company to underwrite an insurance applicant and then issue a policy faster than ever before.

Using various underwriting concepts, insurance companies can offer no medical exam life insurance and still feel comfortable they are taking on the risks (applicants) that will allow them to make a profit.

Accelerated Underwriting

The accelerated underwriting process is becoming the most popular underwriting method for offering affordable life insurance without a medical exam requirement.

It’s important to note, however, that accelerated underwriting is not for every applicant out there who prefers not to have a medical exam. The applicants who generally qualify for this type of underwriting are typically very healthy and as such, the insurance company doesn’t feel it necessary to require a medical exam.

To qualify for accelerated underwriting, the applicant must meet the following conditions:

- Be in excellent health

- Never have been treated for heart disease, diabetes, cancer, or other severe illnesses

- Need less than $1 million in coverage

- Taking no more than one prescribed medication

- Have a credit score of 740 and above

- No major driving violations and less than 3 tickets in the last 3 years

Best No Exam Life Insurance Companies - Accelerated Underwriting

| Insurance Company | Product | Eligible Ages | Death Benefit |

|---|---|---|---|

| American National | Xpress Plus | 20 to 50 | $1000,000 – 1,000,000 |

| Banner Life | OPTerm | 20 to 50 | $100,000 – $1,000,000 |

| Lincoln National | TermAccel | 18 to 60 | $100,000 – $1,000,000 |

| North American | WriteAway | 18 to 60 | $100,000 – $1,000,000 |

| Principal | Term | 18 to 60 | $100,000 – $1,000,000 |

| Protective | Classic Choice Term | 18 to 60 | $50,000 – $1,000,000 |

| Sagicor | Sage Term | 18 to 60 | $100,000 – $500,000 |

Instant Issue

With instant issue underwriting (also known as express issue), the underwriter will typically approve the application or decline it almost immediately.

Rather than requiring a medical exam, the underwriter will consider the applicant’s answers on the application along with a MIB report, Prescription Drug report, and Motor Vehicle report that can be retrieved almost instantly.

To qualify for an instant issue policy, the applicant must meet the following conditions:

- Be in average health (medical conditions well-managed are acceptable)

- Never have been treated for heart disease, immune disorders, or stroke in the previous 5 years.

- Need less than $1 million in coverage

- Taking no more than four prescribed medications

- No DUI/DWI violations in the past 5 years and less than 3 tickets in the last 3 years

Best No Medical Exam Life Insurance Companies - Instant Issue Policies

| Insurance Company | Product | Eligible Ages | Death Benefit |

|---|---|---|---|

| Fidelity Life | Rapid Decision | 18 to 65 | $50,000 – $100,000 |

| Foresters | Your Term | 18 to 80 | $50,000 – $400,000 |

| Minnesota Life | Express Issue | 16 to 55 | $100,000 – $249,999 |

| Transamerica | Simplified Issue | 18 to 60 | $25,000 – $249,999 |

How Much More Does No Exam Life Insurance Cost?

When it comes to life insurance pricing, the risk always determines rates. It used to be if you wanted to bypass the life insurance medical exam, an applicant would pay higher rates because the lack of medical information increased the risk in the eyes of an underwriter.

With new technology, however, insurance underwriters can get a clear picture of an applicant’s health, especially when the applicant has previously applied for life or health insurance.

The risk data is out there and the underwriters know where to look for it. Between new technology and a very competitive marketplace, individuals who are shopping for no exam life insurance will be pleasantly surprised when they find that no exam life insurance rates are about the same as fully underwritten insurance rates, especially when the applicant is very healthy.

Here’s an example of life insurance no medical exam rates compared with fully-underwritten life insurance rates. These rates are based on a very healthy male non-smoker shopping for a 20-year $500,000 Term policy:

$500,000 20-year Term – Male Non-smoker

| Age of Applicant | Rates with Exam | No Exam Rates |

|---|---|---|

| 25 | $18.98 | $19.53 |

| 30 | $19.30 | $19.87 |

| 35 | $21.25 | $22.68 |

| 40 | $29.34 | $31.30 |

| 45 | $47.69 | $48.58 |

| 50 | $72.30 | $80.91 |

| 55 | $114.83 | $151.09 |

| 60 | $199.06 | $274.74 |

Please Note: All rates listed above are rate indications and subject to further underwriting.

This chart illustrates quite plainly that no medical exam life insurance costs just a little more than fully-underwritten life insurance until age 50. For accurate rates for your actual age, please use our instant term insurance form on the right side of the page (at the top on mobile).

Here’s an example of no medical exam life insurance rates compared with fully-underwritten life insurance rates. These rates are based on a very healthy female non-smoker shopping for a 20-year $500,000 Term policy:

$500,000 20-Year Term – Female Non-Smoker

| Age of Applicant | Rates with Exam | No Exam Rates |

|---|---|---|

| 25 | $15.91 | $16.32 |

| 30 | $16.52 | $17.05 |

| 35 | $18.08 | $19.00 |

| 40 | $25.28 | $24.48 |

| 45 | $36.91 | $38.46 |

| 50 | $54.39 | $60.41 |

| 55 | $83.77 | $93.13 |

| 60 | $137.57 | $165.73 |

Please Note: All rates listed above are rate indications and subject to further underwriting.

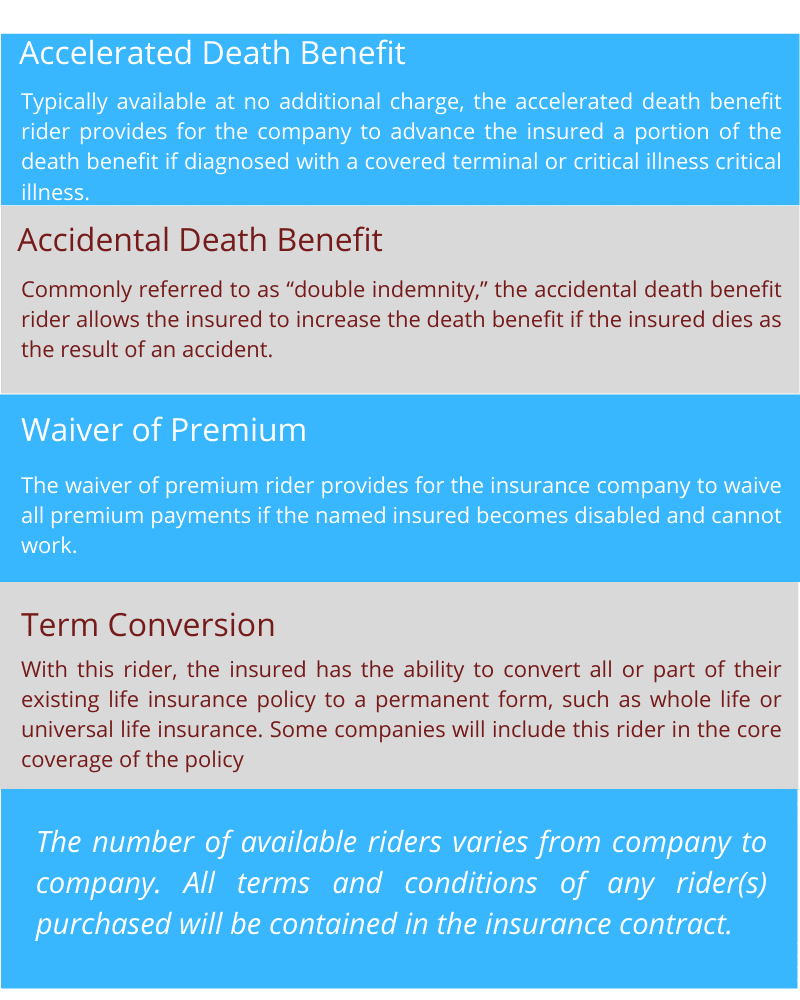

No Exam Life Insurance Policy Riders

Life insurance riders are optional coverages that can broaden your insurance coverage and provide living benefits. Riders allow applicants to customize their insurance coverage to meet their needs and circumstances.

Although we are discussing insurance riders near the end of the insurance purchase process, your independent agent will bring them up during the policy process.

The most popular riders for life insurance no medical exam are:

Need Help Choosing the Right Policy for Your Needs?

For more information about no medical exam life insurance or if you need help choosing the best policy for your needs and circumstances, call us at (866) 691-0100 during normal business hours or contact us through our website at your convenience.

No Exam Life Insurance Quotes

Last Updated on November 11, 2024 by Richard Reich