Protect Your Income with Disability Insurance

The term freelancer is an unusual moniker for someone who is self-employed, but it is used widely to describe that large group of workers who have issues with traditional employment. Although how the term was coined continues to be debated, one can look at the most popular phrase that may have birthed the term:

In the historical novel by Sir Walter Scott in 1820, the term was used to describe a medieval mercenary that would offer their combat skills and weapons to the highest bidder:

“I offered Richard the service of my Free Lances, and he refused them… thanks to the bustling times, a man of action will always find employment.”

Ivanhoe, Sir Walter Scott

What is a Freelancer?

Freelancer is one of several names to describe someone who is self-employed. Freelancers are also known as independent contractors, on-demand workers, moonlighters, and temps or temporary workers. They are a large part of the economy, making up over one-third of the workforce. They even have their own terms to describe what they are doing and how they do it. They are a formidable group of workers, and they are growing, especially because of the Internet.

known as independent contractors, on-demand workers, moonlighters, and temps or temporary workers. They are a large part of the economy, making up over one-third of the workforce. They even have their own terms to describe what they are doing and how they do it. They are a formidable group of workers, and they are growing, especially because of the Internet.

Not long ago, the Freelancers Union, in conjunction with Upwork, commissioned a study about the number of on-demand workers, which was completed and published by Edelman Berland. Here are some interesting statistics found in their report:

- On-demand workers or freelancers make up 34% of the U.S. workforce

- The number of freelancers increased by 700,000 from 2014 to 2015

- The majority of workers who left traditional employment for freelancing earned more money in the first year

- More than half of all freelancers find project work online, an increase of 42% from the previous year

- Over half of the freelancers surveyed reported that they prefer freelancing to traditional employment and would not go back regardless of compensation.

What about the Risk?

Freelancers (or whatever you want to call us) have the same risks as traditional employees but with a  lower amount of stress because they have more control over their workflow. Here, we’re talking about the risks of becoming ill or the risk of becoming injured. Just because freelancers don’t have to commute to their workplace like traditional employees does not mean they do not have considerable risks in their everyday lives.

lower amount of stress because they have more control over their workflow. Here, we’re talking about the risks of becoming ill or the risk of becoming injured. Just because freelancers don’t have to commute to their workplace like traditional employees does not mean they do not have considerable risks in their everyday lives.

Freelancers need all of the same types of insurance as employees. They need car insurance, home insurance, health insurance, life insurance, and, yes, they need Disability Income Insurance. Regarding life insurance, most freelancers overestimate the cost of life insurance. For example, the cost of a $1,000,000 term life insurance policy for a healthy 30-year-old male can cost as low as $35 a month.

5 Reasons Freelancers Need Disability Income Insurance

Certainly, there are more than just five reasons to carry disability income insurance, but the following five apply to almost everybody.

Social Security Disability Just Won’t Cut It –

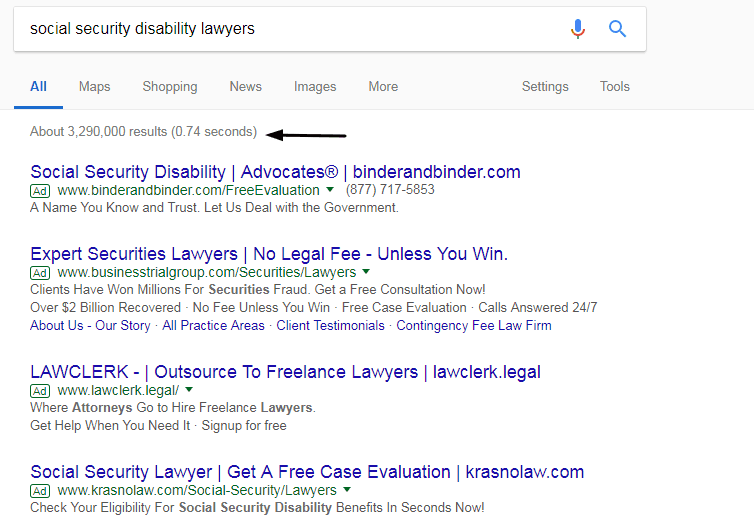

Unless you have a pile of money or a fat retirement plan you can access, you are going to go broke while you wait for Social Security Disability to bail you out when you are too sick or too injured to work. Have you ever wondered why there are so many attorneys that specialize in Social Security Disability? Most initial applications for Social Security Disability benefits are declined, and you almost always have to hire an attorney to fight for you. Here’s a screenshot of a Social Security Disability Lawyer search:

This search returned over 3 million responses!

2. Even working from a Home Office is Risky –

Whether you are a freelance writer or a freelance truck mechanic, there is always the possibility of getting hurt. Certainly, being a truck mechanic might seem more dangerous, but even writers who work from home have to go out once in a while, and that’s where accidents happen the most. When you’re driving, when you’re in a mall, when you’re in a building where there are a lot of people, all of these have a risk of you getting hurt and not being able to work, which means you will not get paid.

And what about an illness? People get sick, and those people get other people sick. And so on, and so on. So you pick up a pesky flu bug in the office supply store, and then the next thing you know, you’re in the hospital with Guillain-Barre syndrome. I have two personal friends that came down with this, and it totally messed up their lives, both physically and financially.

3. Your Dependents depend On Your Income –

What happens if you become disabled and start running out of money. You can’t work, you’re not earning, and now you are maxing out your credit cards to feed the kids. Even if your spouse is providing a large chunk of the household income, can he or she handle the mortgage payments, car payments, and put food on the table? In most cases, no. If you are financially responsible for others it makes even more sense to protect your income with Disability Income Insurance.

4. It’s Easy and It’s Quick –

Today’s independent insurance agents specialize in specific insurance types. Some in life insurance, some in health insurance, and some in Disability Income insurance. It’s so easy to find an independent agent online who understands how freelancers work. They know your risks and they know how to mitigate them. The only thing that you’ll need to make sure of in advance is that you report your income. And certainly, all of us do that, right? Your monthly disability benefit is based on your monthly income so you will need to have a record of it for the insurer. Your agent can walk you through the shopping process, the purchasing process, and the underwriting process. You will not be alone!

5. You can Afford It. It’s not as Expensive as You may have Heard –

Believe it or not, disability income insurance can cost as little as about one percent of your income but the insurance will cover- two-thirds of your income every single year you are working. The insurance rates are based on the risk for the industry you work in so you can understand that insurance for a bookkeeper is going to cost a lot less than insurance for diesel mechanic, But, no matter what industry you are working in, disability income insurance will save you from financial devastation if you become seriously ill or injured. You cannot afford not to buy it!

The Best Kind of Disability Insurance for Freelancers

Freelancers should look for disability insurance policies that are non-cancelable and guaranteed renewable. Guaranteed renewable means that the insurance company cannot cancel the policy under any circumstances unless the policyholder stops paying their premiums. A non-cancelable policy means that the insurance company cannot raise the policy’s premiums or change the policy’s terms.

Disability insurance for freelancers Disability insurance for freelancers should also contain an own-occupation rider. An own-occupation rider dictates what constitutes as a disability. If a freelance web designer lost the use of their hand, the one they use to write code, they would qualify for full disability benefits even if they were still able to work in other capacities. Without an own-occupation rider, freelancers would lose their monthly benefit if they took another job in a different industry, even if it only paid a fraction of their previous monthly income.

If you finally made the jump to working as a freelancer and are prospering and enjoying the freedom it allows, make sure you cover all your insurance bases and do not forget about protecting your income.

For more information about long-term disability insurance, and how you can protect your income, call the disability professionals at LifeInsure at (866) 868-0099 during normal business hours, or contact us through our website at your convenience.

Frequently Asked Questions

Disability insurance provides financial protection in case you become unable to work due to an illness or injury. As a freelancer, you don’t have access to traditional employee benefits like paid sick leave or long-term disability coverage. Disability insurance ensures that you can still receive income even if you’re unable to work, protecting your financial stability.

Freelancers often rely on their ability to work to generate income. If you were to experience a disabling illness or injury, you might be unable to earn money for an extended period. Disability insurance provides a source of income replacement, covering a portion of your lost earnings and helping you manage your financial obligations while you recover.

Disability insurance policies typically have a pre-existing condition exclusion period. This means that disabilities resulting from a pre-existing condition might not be covered for a certain period after the policy is in effect. However, policies can vary, so it’s important to review the terms and conditions carefully to understand how pre-existing conditions are handled.

The cost of disability insurance for freelancers depends on various factors, including your age, health, occupation, coverage amount, and elimination period (waiting period before benefits kick in). Generally, the younger and healthier you are, the lower the premiums. It’s advisable to obtain quotes from multiple insurance providers to compare prices and choose a policy that fits your budget and coverage needs.

Last Updated on November 25, 2024 by Richard Reich